Automotive Reconfigurable Instrument Cluster Market Size 2024-2028

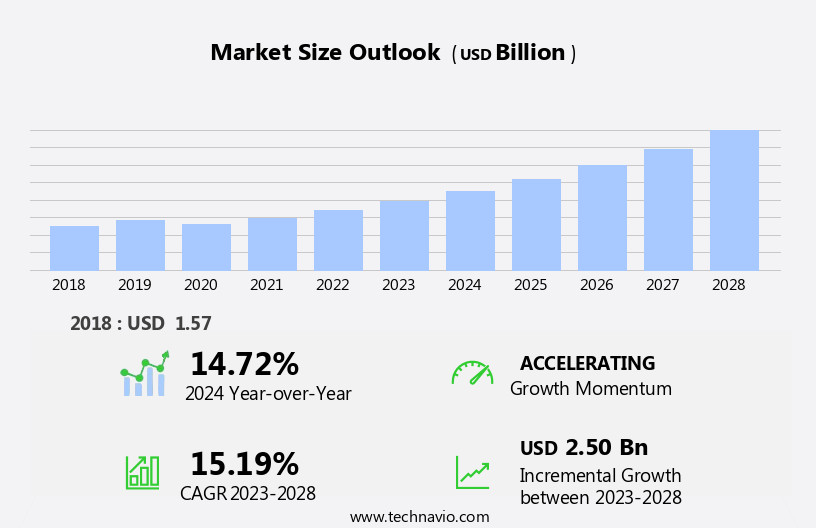

The automotive reconfigurable instrument cluster market size is forecast to increase by USD 2.50 billion at a CAGR of 15.19% between 2023 and 2028.

- The reconfigurable instrument cluster market is experiencing significant growth due to the increasing demand for enhanced vehicle interiors and immersive driving experiences. This trend is driven by consumers' preference for personalized and customizable in-car displays. Moreover, the development of superior graphic displays is enabling automakers to offer more advanced features, such as real-time vehicle information and customizable layouts. However, cost pressure on automotive original equipment manufacturers (OEMs) is limiting the penetration of reconfigurable instrument clusters. Despite this challenge, the market is expected to witness steady growth In the coming years. The integration of advanced technologies, such as augmented reality and artificial intelligence, is expected to further enhance the functionality and appeal of reconfigurable instrument clusters.Overall, the market offers significant opportunities for growth, particularly In the North American region, where consumers are increasingly demanding advanced in-car technologies.

What will be the Size of the Automotive Reconfigurable Instrument Cluster Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for advanced driver-assistance systems (ADAS), connected car technology, and personalized driving experiences. Head-up displays (HUDs), interactive instrument clusters, and smart dashboards are becoming increasingly popular, offering drivers real-time information and enhanced user interface design. Data analytics and digital cockpits enable customized, sustainable transportation solutions, while cybersecurity measures ensure the protection of connected cars. Display technology advancements, such as LCD displays, are driving the future of interiors, with a focus on attractive and accessible instrument clusters. The integration of autonomous driving technology, infotainment systems, electrification, telematics, and connectivity continues to shape the market.

- Cluster customization, cluster hardware, and instrument cluster software are key areas of innovation, providing drivers with a more personalized and safer driving experience. Regulations regarding instrument panel design and cluster accessibility are also influencing market trends. Overall, the market is evolving to meet the demands of future mobility and the changing needs of consumers.

How is this Automotive Reconfigurable Instrument Cluster Industry segmented and which is the largest segment?

The automotive reconfigurable instrument cluster industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Partially reconfigurable instrument cluster

- Fully reconfigurable instrument cluster

- Application

- Passenger cars

- Commercial vehicles

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

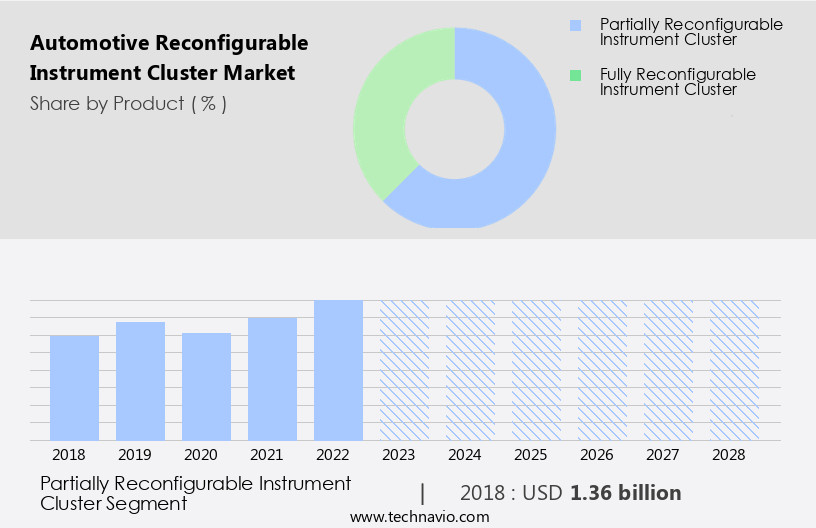

By Product Insights

- The partially reconfigurable instrument cluster segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing adoption of digital instrument clusters in passenger cars. These digital clusters offer customizable features, enabling vehicle original equipment manufacturers (OEMs) to differentiate their offerings in various car models. Moreover, the integration of advanced display technologies such as OLED and LCD, voice recognition, and touch-sensitive controls enhances the user experience and driving experience. Additionally, the market is driven by the need for environmental sustainability and adherence to emission standards, leading to the development of fuel-efficient driving and eco-driving indicators. The market is expected to grow significantly in developed regions like North America and Europe, where there is a high demand for advanced technological features in vehicles.

The use of microprocessors, integrated circuits, and warning indicators In these clusters ensures safety and regulatory compliance. The market also includes hybrid instrument clusters, which offer a combination of analog and digital displays, catering to both entry-level and luxury cars. The integration of smartphone connectivity, maintenance cost reduction, and safety regulations further boosts the market growth.

Get a glance at the Automotive Reconfigurable Instrument Cluster Industry report of share of various segments Request Free Sample

The Partially reconfigurable instrument cluster segment was valued at USD 1.36 billion in 2018 and showed a gradual increase during the forecast period.

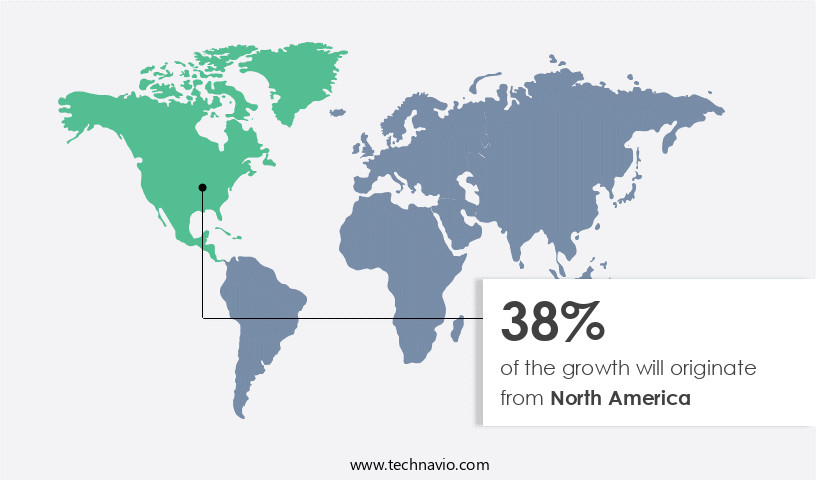

Regional Analysis

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market for automotive reconfigurable instrument clusters is poised for growth due to the region's early adoption of advanced technologies and increasing penetration of hybrid instrument clusters in passenger vehicles. The US, in particular, is a significant contributor to this market, driven by its focus on autonomous vehicles and the testing of automated vehicles in select states. The adoption of digital and OLED displays, touch-sensitive controls, voice recognition, and eco-driving indicators In these clusters enhances the user experience and driving experience. Additionally, the integration of smartphone connectivity, warning indicators, and safety regulations further boosts the market. Innovations such as haptic feedback, microprocessors, and integrated circuits are expected to drive technological advancements in this sector.

The market for automotive reconfigurable instrument clusters includes various types, such as hybrid, digital, and analog clusters, catering to different segments, including passenger cars, light commercial vehicles, and heavy commercial vehicles. The market is expected to benefit from urbanization, fuel-efficient driving, and the increasing demand for environmental sustainability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Reconfigurable Instrument Cluster Industry?

Growing demand for enhanced vehicle interiors and immersive driving experience is the key driver of the market.

- In the automotive sector, there is a growing trend towards advanced instrument clusters that cater to modern consumer preferences. Reconfigurable instrument clusters, which replace traditional analog dials with digital displays, are at the forefront of this innovation. These clusters offer customizable, dynamic displays that can show real-time information on various parameters such as fuel efficiency, speed, temperature, navigation, and safety alerts. Hybrid instrument clusters, which combine both analog and digital elements, are gaining popularity in passenger cars, electric three-wheelers, and light commercial vehicles. These clusters often feature touch-sensitive controls, voice recognition, and smartphone integration, enhancing the user experience and driving experience.

- Technological advancements, such as OLED and LCD displays, microprocessors, and integrated circuits, enable the production of sleek, high-resolution screens. These displays offer vivid graphics, intuitive icons, and augmented reality overlays, contributing to a more immersive and eco-friendly driving experience. Moreover, reconfigurable instrument clusters help improve fuel-efficient driving by providing eco-driving indicators and haptic feedback. They also offer warning indicators for safety regulations, making the driving experience safer and more environmentally sustainable. In the instrument cluster market, there is a shift towards digitization, with digital clusters becoming increasingly common in luxury cars and entry-level vehicles alike. This trend is driven by the desire for a more personalized and visually engaging driving experience, as well as the need to comply with emission standards and safety regulations.

- In conclusion, reconfigurable instrument clusters represent a significant advancement In the automotive industry, offering a more personalized, visually engaging, and eco-friendly driving experience. These clusters are becoming an essential component of modern vehicles, as consumers demand more sophisticated interfaces and automakers seek to comply with safety and emission regulations.

What are the market trends shaping the Automotive Reconfigurable Instrument Cluster Industry?

Development of superior graphic displays is the upcoming market trend.

- The reconfigurable instrument cluster market In the automotive sector is experiencing significant growth due to the integration of advanced technologies. These clusters enable customization of the information displayed, making them increasingly popular. Hybrid instrument clusters, which combine physical gauges with digital displays, are gaining traction in passenger cars, electric three-wheelers, and light commercial vehicles. Innovative features such as voice recognition, emission standards compliance, and user experience enhancements are driving the demand for these clusters. Display technologies like OLED, LCD, and LED are being used to create sleek and efficient instrument clusters. Touch-sensitive controls, microprocessors, and warning indicators are other essential components.

- Safety regulations are also influencing the design and production of instrument clusters, with parameters like speedometer, tachometer, and temperature gauge being critical. Technological advancements, such as digital devices and graphic displays, are revolutionizing the instrument cluster market. Fuel-efficient driving and eco-driving indicators are becoming essential features for fuel-conscious consumers. Haptic feedback and smartphone integration are additional enhancements that are improving the driving experience. The reconfigurable instrument cluster market is witnessing significant innovation, with companies focusing on creating customizable and eco-friendly solutions. Safety, display, and hybrid clusters are the main sectors, catering to entry-level, luxury, and heavy commercial vehicles.

- The integration of microprocessors, integrated circuits, and other digital devices is enabling the development of more sophisticated and cost-effective clusters. Environmental sustainability is a key consideration In the design and production of instrument clusters. As urbanization continues to grow, the demand for fuel-efficient and eco-friendly vehicles is increasing. The instrument cluster market is responding to this trend by offering digital and hybrid solutions that provide real-time information on fuel consumption and emissions. In conclusion, the reconfigurable instrument cluster market is a dynamic and evolving sector In the automotive electronics industry. The integration of advanced technologies, focus on user experience, and emphasis on environmental sustainability are driving the growth of this market.

- companies are responding to these trends by developing innovative and customizable solutions that cater to the diverse needs of consumers.

What challenges does the Automotive Reconfigurable Instrument Cluster Industry face during its growth?

Cost pressure on automotive OEMs leading to low penetration of reconfigurable instrument clusters is a key challenge affecting the industry growth.

- In the automotive sector, the instrument cluster market is witnessing significant innovation with the integration of advanced technologies. Traditional analog instrument clusters are being replaced by digital and hybrid clusters, featuring touch-sensitive controls, voice recognition, and eco-driving indicators. Hybrid instrument clusters, which combine physical gauges with digital displays, are gaining popularity in passenger cars, electric three-wheelers, and light commercial vehicles. Display technologies such as OLED and LCD are increasingly being used to enhance the user experience and driving experience. Safety regulations mandate the inclusion of warning indicators, fuel gauge, and speedometer, among other parameters, in instrument clusters. Microprocessors and integrated circuits are essential components of these advanced clusters.

- Technological advancements, including smartphone integration and haptic feedback, are further enhancing the functionality and convenience of digital instrument clusters. Fuel-efficient driving and environmental sustainability are key priorities for consumers, leading to the adoption of eco-driving indicators and digitization of fuel gauges. The instrument cluster market is subject to safety regulations and production costs, which can impact the price and demand for these advanced clusters. In the value chain, automotive OEMs face cost pressures due to regulatory requirements and consumer demands for advanced features. The market for instrument clusters is expected to grow as urbanization increases the demand for fuel-efficient and technologically advanced vehicles.

Exclusive Customer Landscape

The automotive reconfigurable instrument cluster market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive reconfigurable instrument cluster market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive reconfigurable instrument cluster market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

BlackBerry Ltd. - The reconfigurable instrument cluster market demands robust operating systems for mission-critical automotive applications. Our company provides solutions featuring QNX Neutrino real-time operating system, ensuring optimal performance, security, and reliability. This operating system caters to the evolving requirements of automotive systems, enabling customizable displays and advanced functionalities. By integrating QNX Neutrino, automakers can deliver enhanced user experiences while maintaining the highest safety standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BlackBerry Ltd.

- Caerbont Automotive Instruments Ltd.

- Continental AG

- DENSO Corp.

- Hyundai Motor Co.

- ID4Motion

- International Automotive Components Group SA

- Marelli Holdings Co. Ltd.

- Nippon Seiki Co. Ltd.

- NVIDIA Corp.

- NXP Semiconductors NV

- Panasonic Holdings Corp.

- Pricol Ltd.

- Renesas Electronics Corp.

- Robert Bosch GmbH

- Stoneridge Inc.

- Texas Instruments Inc.

- Toshiba Corp.

- Visteon Corp.

- Yazaki Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The instrument cluster market encompasses a diverse range of technologies and applications withIn the automotive industry. Traditional instrument clusters, also known as analog clusters, have long been a staple in passenger cars, featuring physical gauges for parameters such as speed, fuel level, and engine temperature. However, the sector is undergoing significant transformation as technological advancements drive the shift towards digital instrument clusters. Digital instrument clusters, which utilize LCD or OLED displays, offer numerous advantages over their analog counterparts. These advantages include the ability to provide real-time information, customizable layouts, and integration with digital devices such as smartphones. Additionally, digital clusters can offer eco-driving indicators, fuel-efficient driving information, and warning indicators, enhancing the driving experience for consumers.

Moreover, the integration of touch-sensitive controls and voice recognition technology further enhances the user experience, allowing drivers to access important information and adjust settings with ease. Safety regulations also play a crucial role In the instrument cluster market, with safety indicators and warnings becoming increasingly important features. The production of instrument clusters involves the use of microprocessors and integrated circuits, allowing for advanced functionality and connectivity. The market for instrument clusters is not limited to passenger cars, with applications in light commercial and heavy commercial vehicles as well. The trend towards digitization and innovation In the automotive industry is driving the growth of the instrument cluster market.

Fuel efficiency and environmental sustainability are key priorities for consumers, and digital instrument clusters offer features that can help improve fuel efficiency and reduce emissions. Furthermore, the increasing popularity of autonomous vehicles is expected to create new opportunities for instrument cluster technology. The instrument cluster market is a dynamic and competitive sector, with various players offering innovative solutions to meet the evolving needs of consumers. Technological advancements, safety regulations, and consumer preferences are key drivers of market growth and innovation. The market is expected to continue to evolve as the automotive industry embraces digital technologies and strives to enhance the driving experience for consumers.

In conclusion, the instrument cluster market is an essential component of the automotive industry, undergoing significant transformation as technological advancements drive the shift towards digital instrument clusters. Digital instrument clusters offer numerous advantages over traditional analog clusters, including real-time information, customizable layouts, and integration with digital devices. Safety regulations, fuel efficiency, and environmental sustainability are key priorities for consumers, and digital instrument clusters offer features that can help address these concerns. The market for instrument clusters is dynamic and competitive, with various players offering innovative solutions to meet the evolving needs of consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.19% |

|

Market growth 2024-2028 |

USD 2.50 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.72 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Reconfigurable Instrument Cluster Market Research and Growth Report?

- CAGR of the Automotive Reconfigurable Instrument Cluster industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive reconfigurable instrument cluster market growth of industry companies

We can help! Our analysts can customize this automotive reconfigurable instrument cluster market research report to meet your requirements.