Automotive Pump Market Size 2024-2028

The automotive pump market size is forecast to increase by USD 3.49 billion at a CAGR of 4.14% between 2023 and 2028.

- The market is driven by the expansion of the passenger automobile industry, particularly in emerging economies. Another significant growth factor is the increasing adoption of electric vehicle (EV) technologies and vehicle electrification.

- However, challenges such as the high cost of electric fuel pumps and stringent environmental laws pose hurdles to market growth. Moreover, advancements in automation technologies are transforming the industry, enabling improved fuel efficiency and reducing emissions. The report provides a comprehensive analysis of these trends and challenges, offering insights into the future growth prospects of the market. For businesses aiming to capitalize on these opportunities, the report serves as a valuable resource, shedding light on the key market drivers, challenges, and future growth prospects.

What will be the Automotive Pump Market Size During the Forecast Period?

- The market in the US is witnessing significant changes as automotive original equipment manufacturers (OEMs) respond to stringent environmental regulations and the shift towards electric vehicles (EVs). The focus on reducing carbon emissions, particularly in urban areas and megacities, is driving the demand for advanced pump technologies in various vehicle sub-systems. Carbon emission norms have become increasingly stringent, compelling automotive OEMs to explore alternative fuel sources and technologies. Conventional fuel vehicles continue to dominate the market, but the adoption of EV technologies and vehicle electrification is on the rise.

-

For instance, the use of direct fuel injection systems and advanced turbocharging technologies requires the development of specialized fuel pumps to ensure optimal performance. The increasing adoption of EVs is also driving the demand for new pump solutions. In EVs, pumps are used for various applications, such as cooling the battery pack, circulating the coolant, and delivering the charging current. The development of EV technologies is leading to the creation of new pump designs and materials that can handle the unique requirements of these vehicles. The use of paint and solvents in the automotive industry is another area where pumps play a crucial role.

-

The application of these materials generates volatile organic compounds (VOCs), which contribute to photochemical haze and other environmental issues. The development of low-VOC and water-based coatings is driving the demand for pumps that can handle these new materials effectively. In conclusion, the market in the US is undergoing significant changes as automotive OEMs adapt to regulatory requirements and technological advancements. The focus on reducing carbon emissions, improving fuel efficiency, and developing new EV technologies is driving the demand for advanced pump solutions in various applications. The market is expected to grow steadily as automotive OEMs continue to innovate and respond to changing market conditions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Mechanical

- Automatic

- Application

- Passenger cars

- Commercial vehicles

- Geography

- Europe

- Germany

- UK

- North America

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

By Type Insights

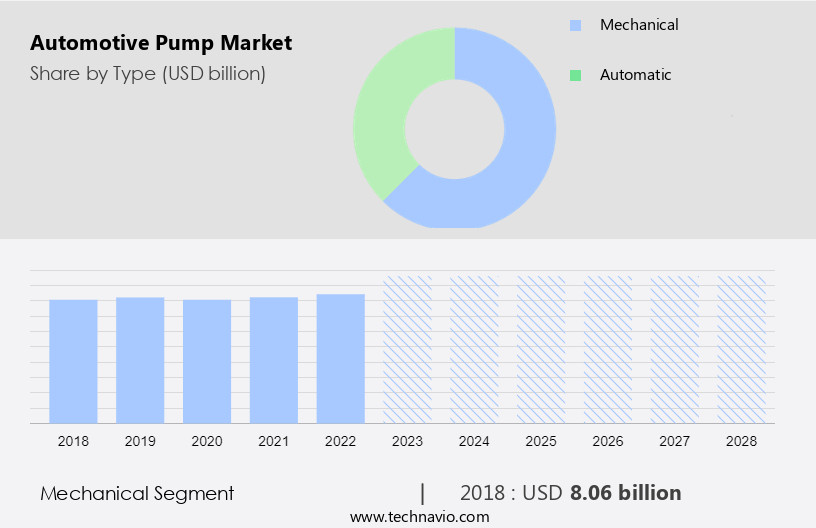

- The mechanical segment is estimated to witness significant growth during the forecast period.

Mechanical pumps serve a vital role in various transportation industries, including those utilizing vans, utility trucks, buses, trains, and motorcycles. These pumps are classified as positive displacement types, which employ automated mechanisms to generate fluid flow. Primarily, they are employed for pumping fuel or coolant. In the context of automobiles, mechanical fuel pumps are indispensable components of the fuel system. These pumps operate by utilizing a lever to create suction, drawing fuel from the tank, and delivering it to the carburetor or fuel injection system. Two primary categories of mechanical pumps exist: low-pressure mechanical pumps and high-pressure mechanical pumps.

Low-pressure pumps are designed to generate flow at minimal pressures. Once the outlet pressure surpasses the pump's capacity, the pump will cease creating flow. For instance, low-pressure pumps operate at a fuel pressure of around 10-15 psi. In the realm of transportation, sensors play a significant role in monitoring and optimizing the performance of mechanical pumps. These sensors provide real-time data, enabling proactive maintenance and enhancing overall efficiency. As the transportation sector continues to evolve, the demand for advanced mechanical pumps and related technologies is expected to grow.

Get a glance at the market report of share of various segments Request Free Sample

The Mechanical segment was valued at USD 8.06 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

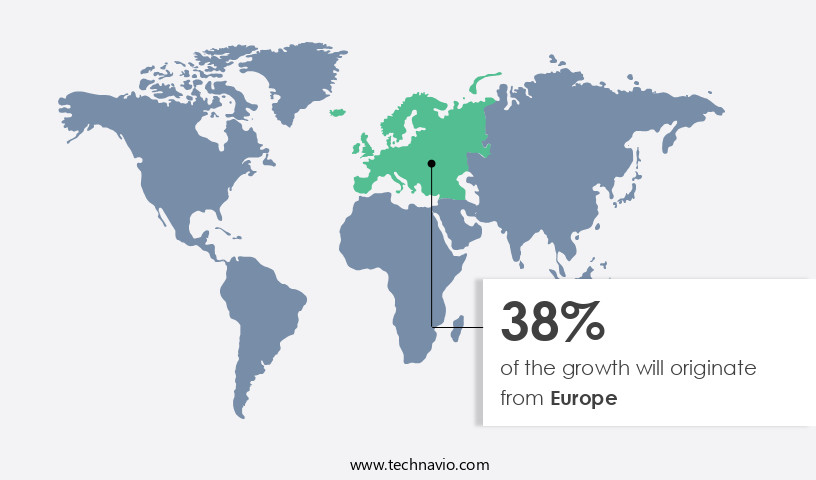

- Europe is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market is projected to exhibit a steady expansion during the forecast period. Major contributors to this market in Europe include Germany, France, Italy, Spain, and the United Kingdom. These nations have a significant demand for sophisticated fuel injection systems in vehicles and enforce stringent emission regulations. Europe is a pioneering region in the development of advanced automotive technologies. However, the growing popularity of electric vehicles in the region poses a challenge to the market, as most pumps are designed for use in vehicles with internal combustion engines (ICEs). Inverter cooling technologies and advanced combustion systems are driving the evolution of cooling technologies in the automotive industry. Carbon emissions remain a major concern, leading to the development of more efficient and eco-friendly cooling systems. Vehicle sub-systems, such as the cooling system, play a crucial role in ensuring optimal vehicle performance and reducing emissions.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Automotive Pump Market?

Growth of automotive industry in emerging economies is the key driver of the market.

- The expanding economies of emerging markets significantly contribute to the global expansion of the automotive pump industry. The rise in economic activity in developing nations has resulted in an increase in per capita income, leading to a growing demand for personal vehicles. With urbanization and the subsequent growth of major cities, public transportation infrastructure struggles to keep pace with population growth and the resulting transportation needs. According to World Bank data, China's population accounts for approximately one-fifth of the world's total population. This urbanization trend has resulted in a surge in demand for automotive pumps, particularly in applications related to electric vehicles (EVs), emission control systems, radiators, and the handling of liquefied gases used in paint and solvents. As governments and businesses in these markets invest in reducing photochemical haze and improving emission levels, the market is poised for continued growth.

What are the market trends shaping the Automotive Pump Market?

Developments in field of hydrocarbon evaporation control systems is the upcoming trend in the market.

- The automotive industry in the United States is prioritizing efforts to minimize environmental impact. Various stakeholders, including automotive suppliers and government bodies, are collaborating to create a more sustainable automotive sector. This focus on sustainability has led to advancements and innovations in automotive technology and systems, which help reduce harmful emissions. One notable example is Continental Automotive GmbH, a leading Tier-1 supplier in The market. In response to stringent hydrocarbon evaporation legislation, Continental has introduced an electrified solution to reduce emissions. Specifically, they have developed an electric Active Purge Pump. This technology is designed to eliminate hydrocarbon-laden air from the canister, thereby minimizing evaporative hydrocarbon emissions. By implementing this electric pump, Continental is contributing to the broader goal of creating a more eco-friendly automotive industry.

What challenges does Automotive Pump Market face during the growth?

High cost of electric fuel pumps is a key challenge affecting the market growth.

- Electric fuel pumps play a vital role in the performance of automotive fuel systems by delivering fuel at high pressure and precise quantities to the engine intake manifold in passenger automobiles. A malfunctioning electric fuel pump can negatively impact engine performance, potentially causing inadequate fuel supply and reduced engine efficiency. Replacing a faulty electric fuel pump can be costly, making it essential for automakers to source these components from reliable companies. The shift towards electric vehicle (EV) technologies and vehicle electrification is driving the demand for electric fuel pumps in the automotive industry. Environmental laws and regulations are also pushing automakers to adopt more efficient fuel systems. Furthermore, automation technologies are being integrated into fuel pump systems to enhance performance and reduce maintenance requirements.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bapcor Ltd.

- BorgWarner Inc.

- Carter Fuel Systems LLC

- CHIESI Farmaceutici SpA

- Concentric AB

- Continental AG

- Cummins Inc.

- DENSO Corp.

- GMB CORP.

- Hitachi Ltd.

- Johnson Electric Holdings Ltd.

- Mitsubishi Electric Corp.

- Pricol Ltd.

- Rheinmetall AG

- Robert Bosch GmbH

- SHW AG

- Stellantis NV

- TI Fluid Systems Plc

- Toyota Motor Corp.

- Valeo SA

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for advanced vehicle sub-systems in both conventional fuel vehicles and electric vehicles (EVs). Strict carbon emission norms in urban areas have led automotive OEMs to focus on reducing emissions from combustion engines by implementing cooling technologies such as electric coolant pumps and inverter cooling. Moreover, the shift towards EVs and vehicle electrification is driving the demand for batteries, electric motors, and pumps, including mechanical and electric pumps.

Moreover, commercial vehicles, such as vans, utility trucks, buses, and trains, also require various types of pumps for their operations. Sensors, microcontrollers, actuators, and other automation technologies are increasingly being integrated into pumps to improve their performance and efficiency. The market is expected to grow further due to the increasing adoption of EVs, stringent environmental laws, and the need for automation in various vehicle systems. The market is also witnessing innovation in cooling technologies for EVs, such as the use of liquefied gases and advanced radiators, to address the unique cooling requirements of EVs.

The Automotive Pump Market is a significant segment of the global industrial pumps industry, driven by the growing demand for advanced vehicle sub-systems in gasoline or diesel passenger cars and electric and hybrid vehicles. The market encompasses various types of pumps, including automotive fuel injection pumps, mechanical pumps, hydraulic steering pumps, electric coolant pumps (EWPS), and electric water pumps. Automotive fuel injection pumps have evolved from mechanical designs to electronic fuel injection (EFI) systems, utilizing microcontrollers for precise fuel delivery. These advancements have led to improved combustion technologies and enhanced vehicle performance. Hydraulic steering pumps and electric power steering systems have also gained popularity, offering better fuel efficiency and driving comfort.

Moreover, the hatchback segment is a significant contributor to the market growth, with the increasing demand for compact and fuel-efficient vehicles. Automatic transmission systems and electric and hybrid vehicles are also driving the market, with the integration of electric water pumps and other vehicle sub-systems. Overall, the Automotive Pump Market is expected to grow steadily, driven by advancements in technology and the increasing demand for fuel-efficient and eco-friendly vehicle solutions.

|

Automotive Pump Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.14% |

|

Market growth 2024-2028 |

USD 3.49 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.7 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch