Automotive Premium Tires Market Size 2024-2028

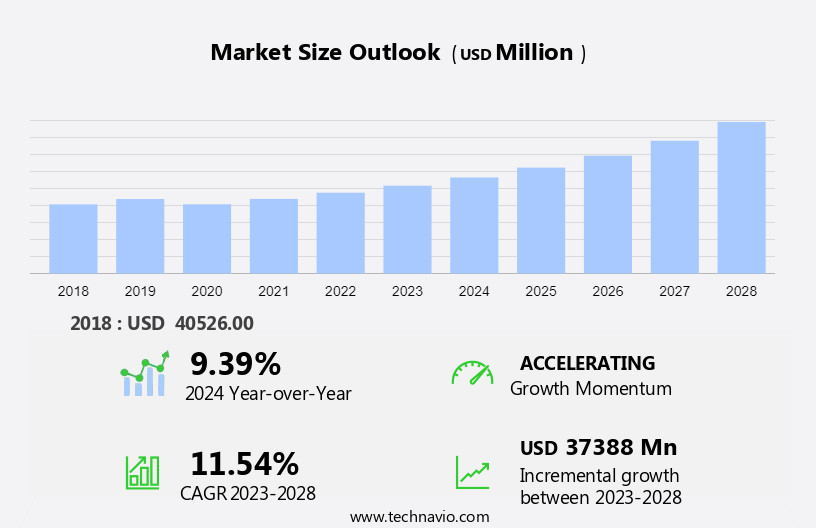

The automotive premium tires market size is forecast to increase by USD 37.39 billion at a CAGR of 11.54% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key trends. One of the primary factors fueling market expansion is the increasing penetration of Tire Pressure Monitoring Systems (TPMS) in truck tires. This technology enhances safety and efficiency, leading to a higher demand for premium tires. Another trend is the rising preference for environment-friendly tires, as consumers become more conscious of their carbon footprint. Price fluctuations of rubber, a crucial raw material, also impact market dynamics. Manufacturers employ advanced manufacturing technology, including synthetic rubber and elastomer grades, to produce high-performing, durable, and affordable tires. Despite these growth opportunities, the market faces challenges such as intense competition and the high cost of premium tires, which may limit market penetration among price-sensitive consumers. Overall, the market is poised for steady growth, with a focus on innovation, sustainability, and cost competitiveness.

What will be the Size of the Automotive Premium Tires Market During the Forecast Period?

- The automotive premium tire market caters to vehicle owners seeking superior performance, durability, and sustainability In their tire purchases. Premium tires offer enhanced fuel economy, convenience, and product differentiation, making them an attractive choice for both personal and commercial applications. Manufacturing technology advances continue to drive innovation, with OEMs integrating premium tires as standard equipment on new vehicles. Aftermarket sales of premium tires are also, driven by the increasing popularity of SUVs, crossover vehicles, and commercial fleet operators. Cost-effective retreaded tires provide an alternative for those seeking affordability without compromising on performance or durability. Sustainability is a growing trend In the market, with manufacturers focusing on producing eco-friendly tires using green energy and advanced materials.

- Premium tires are also favored in various sectors, including motorsports events, sports, racing, and extreme terrain rallies, where superior traction and durability are essential. Operating costs remain a key consideration, with manufacturers striving to balance affordability and performance.

How is this Automotive Premium Tires Industry segmented and which is the largest segment?

The automotive premium tires industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Replacement

- OEM

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- France

- Middle East and Africa

- South America

- North America

By End-user Insights

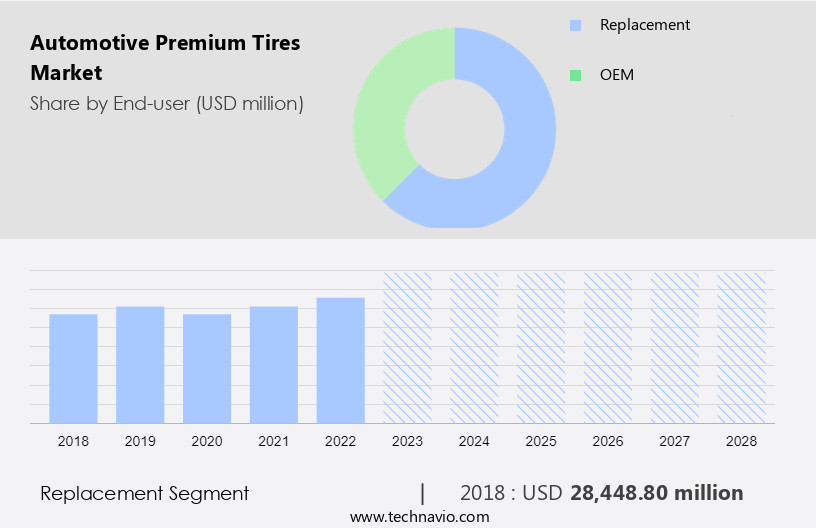

- The replacement segment is estimated to witness significant growth during the forecast period.

The premium tires market experienced significant growth in North America and Europe, accounting for nearly 80% of sales in 2023. The replacement tire segment's expansion is primarily driven by the balance between a premium tire's performance and lifespan. Automotive premium tire manufacturers prioritize safety, comfort, and performance during design and development. These tires offer low rolling resistance, which enhances overall performance but results in faster wear and tear. Consequently, the replacement frequency for premium tires is higher than conventional tires due to their shorter lifetimes. Additionally, premium tires contribute to fuel economy and offer convenience to vehicle owners.

Commercial fleet operators and commercial vehicles, including SUVs, crossover vehicles, and construction vehicles, also utilize premium tires for their durability and cost-effectiveness In the long run. Innovative products In the tire manufacturing industry, such as radial tires and 3D printing, further enhance the market's growth.

Get a glance at the market report of share of various segments Request Free Sample

The Replacement segment was valued at USD 28.45 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

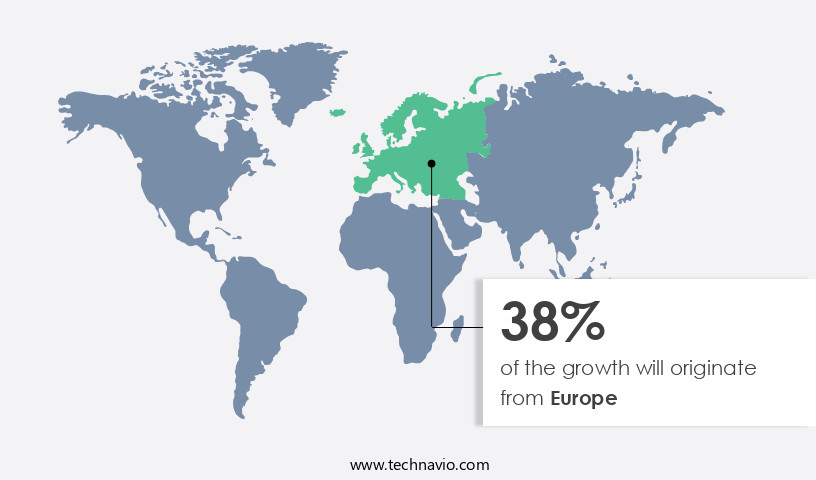

- Europe is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market, specifically the US, Canada, and Mexico, holds a significant share In the market. The focus on maintenance, replacement, and fuel economy, as well as the convenience offered by premium tires, contributes to their popularity among vehicle owners.

Manufacturing technology advancements and product differentiation are key drivers In the market, with a growing emphasis on sustainability, durability, and affordability. Commercial fleet operators and commercial vehicles, including SUVs, crossover vehicles, construction vehicles, and motorsports events, also contribute to the market's growth. Innovative products, such as those made with synthetic rubber and advanced elastomer grades, are gaining traction In the market. The tire machinery industry continues to evolve, with automation and quality improvements playing a crucial role. The increasing sales of passenger cars and light commercial vehicles further fuel the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Premium Tires Industry?

Increasing penetration of TPMS in truck tires is the key driver of the market.

- The Automotive Premium Tire market is experiencing significant growth due to the increasing focus on maintenance and replacement by vehicle owners. Tire Pressure Monitoring Systems (TPMS) are being adopted increasingly in passenger cars and have become a preferred choice among commercial fleet operators. The TPMS system plays a crucial role in ensuring tire health and safety by alerting drivers about under-inflated tires, reducing fleet downtime, and enhancing fuel economy. Under-inflated tires increase rolling resistance and fuel consumption, leading to higher operating costs. The tire industry is witnessing advancements in manufacturing technology, resulting in innovative products such as radial tires, synthetic rubber, and elastomer grades.

- Premium quality tires offer improved durability, sustainability, and affordability, making them a popular choice for passenger vehicles, SUVs, crossover vehicles, commercial vehicles, construction vehicles, and even motorsports events. The tire machinery industry is also evolving with automation and 3D printing technology, contributing to the production of high-performance tires for various applications, including on-road and off-road.

What are the market trends shaping the Automotive Premium Tires Industry?

Increasing demand for environment-friendly tires is the upcoming market trend.

- The automotive premium tire market is witnessing a shift towards eco-friendly and sustainable products, as vehicle owners prioritize fuel economy and environmental concerns. OEMs and tire manufacturers are responding by investing in research and development of energy-efficient tires. These tires, which use advanced synthetic rubbers and elastomer grades, offer significant fuel savings and reduced carbon emissions. This trend is driven by increasing awareness of sustainability and the need for cost-effective solutions for both consumers and commercial fleet operators. The tire manufacturing industry is also embracing automation, manufacturing technology, and innovative products to enhance the quality of tires and meet the demands of various applications, including passenger vehicles, light commercial vehicles, off-road vehicles, and motorsports events.

- The radial tire segment, which dominates the market, is expected to continue its growth trajectory due to its superior performance and durability. The aftermarket for retreaded tires is also gaining traction as a cost-effective solution for vehicle maintenance. Overall, the automotive premium tire market is poised for growth, driven by the rising sales of automobiles, particularly passenger cars and light trucks, and the need for performance excellence and premium quality tires for various on-road and off-road applications.

What challenges does the Automotive Premium Tires Industry face during its growth?

Price fluctuations of rubber is a key challenge affecting the industry growth.

- The market is influenced by the dynamics of the rubber industry, as rubber is the primary raw material used in tire manufacturing. Price fluctuations in rubber can impact the entire value chain, including vehicle owners, OEMs, and aftermarket players. Premium tires offer benefits such as improved fuel economy, convenience, and enhanced performance for various applications, including passenger cars, SUVs, crossover vehicles, commercial fleets, and motorsports events. However, the affordability of these tires can be a concern for some buyers. The tire manufacturing industry invests in innovative products and manufacturing technology, including synthetic rubber, elastomer grades, 3D printing, automation, and tire building machinery, to improve tire quality and durability.

- The rising sales of automobiles, particularly passenger cars and light commercial vehicles, contribute to the demand for premium tires. Market players focus on product differentiation, sustainability, and operating cost efficiency to cater to diverse customer needs and preferences. Retreaded tires offer a cost-effective alternative for commercial vehicle operators, including those In the construction industry. The tire manufacturing industry continues to evolve, with a focus on performance excellence and premium quality tires for on-road and off-road applications.

Exclusive Customer Landscape

The automotive premium tires market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive premium tires market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive premium tires market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bridgestone Corp.

- Cheng Shin Rubber Ind. Co. Ltd.

- Continental AG

- Giti Tire Pte. Ltd.

- Hankook Tire and Technology Co. Ltd.

- Kumho Tire Co. Inc.

- Michelin Group

- MRF Ltd.

- NEXEN TIRE Corp.

- Nokian Tyres Plc.

- Pirelli and C S.p.A

- Shandong Hengfeng Rubber and Plastic Co. Ltd.

- Shandong Linglong Tyre Co. Ltd.

- The Goodyear Tire and Rubber Co.

- Toyo Tire Corp.

- Triangle Tyres

- Xingyuan Tires Group

- Yokohama Rubber Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive premium tire market caters to the demands of vehicle owners seeking superior performance, durability, and sustainability In their tire purchases. Premium tires offer enhanced fuel economy, convenience, and reduced maintenance costs, making them an attractive option for both personal and commercial use. Manufacturing technology plays a significant role In the premium tire market, with Original Equipment Manufacturers (OEMs) and aftermarket providers continuously investing in innovative products and processes. Product differentiation is a key driver In the market, with manufacturers focusing on various elastomer grades, synthetic rubber, and advanced manufacturing techniques such as 3D printing and automation. The tire industry is experiencing in sales, driven by the rising demand for automobiles, light commercial vehicles, SUVs, and crossover vehicles.

This trend is observed in various applications, including on-road and off-road applications, and extends to commercial vehicles, construction vehicles, and motorsports events. Premium tires are often associated with performance excellence and premium quality, offering improved handling, traction, and safety features. The tire machinery industry is also evolving, with a focus on tire building machinery, tire uniformity, dynamic balance, and tire building equipment. Sustainability is becoming increasingly important In the tire market, with a growing emphasis on green energy and eco-friendly manufacturing processes. Retreaded tires are gaining popularity as a cost-effective alternative to new tires, offering both economic and environmental benefits.

The affordability of premium tires remains a consideration for vehicle owners and commercial fleet operators. While the initial investment may be higher than that of standard tires, the operating cost savings and extended tire life make up for the difference In the long run. The tire market is diverse, catering to various applications and customer preferences. This includes sports and racing, extreme terrain rallies, and commercial applications. The market is competitive, with manufacturers continually seeking to differentiate themselves through product innovation and quality. Raw materials, such as elastomer grades and synthetic rubber, play a crucial role in tire manufacturing.

The use of advanced materials and manufacturing techniques enables tire manufacturers to produce tires with improved durability, performance, and sustainability. The automotive premium tire market is driven by various factors, including manufacturing technology, product differentiation, sustainability, affordability, and customer preferences. The market is dynamic and competitive, with continuous innovation and investment in research and development shaping the future of the industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.54% |

|

Market growth 2024-2028 |

USD 37.39 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.39 |

|

Key countries |

US, Germany, China, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Premium Tires Market Research and Growth Report?

- CAGR of the Automotive Premium Tires industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive premium tires market growth of industry companies

We can help! Our analysts can customize this automotive premium tires market research report to meet your requirements.