Artificial Intelligence Market in the Industrial Sector Size 2024-2028

The artificial intelligence market in the industrial sector size is forecast to increase by USD 29.3 billion at a CAGR of 38.86% between 2023 and 2028.

- The artificial intelligence (AI) market in the industrial sector is experiencing significant growth, driven by several key trends. Digital twin technology is gaining traction in industries, enabling real-time monitoring and predictive maintenance of machinery. The emergence of the Industrial Internet of Things (IIoT) is facilitating the integration of AI into industrial processes, enhancing efficiency and productivity. However, the lack of technical knowledge among operators poses a challenge, necessitating the development of user-friendly AI solutions.

- Additionally, data security and privacy concerns are becoming increasingly important, requiring strong security measures to protect sensitive industrial data. Overall, the AI market in the industrial sector is poised for substantial growth, driven by these trends and the need to optimize industrial processes and enhance productivity.

What will be the Artificial Intelligence Market Size in the Industrial Sector During the Forecast Period?

- Artificial Intelligence (AI) is revolutionizing the industrial sector with its ability to enhance efficiency, productivity, and accuracy. Big data and AI are at the heart of this transformation, with machine learning algorithms enabling real-time monitoring and predictive maintenance of industrial machines. Speech processing and natural language processing are key components of AI, enabling seamless communication between humans and smart machines. Generative AI and computer vision are driving innovation in areas such as quality control and supply chain optimization. Intelligent robotics are being integrated into manufacturing processes to automate repetitive tasks and improve overall production. Technology and communication are being transformed by AI, with chatbots and AI art generators enabling new forms of content creation.

- Additionally, federated learning and explainable AI are emerging trends, enabling decentralized machine learning and improving the transparency and interpretability of AI systems. Decision-making is being enhanced through AI, with real-time data analysis and predictive analytics enabling more informed decisions. Edge AI is also gaining traction, enabling AI processing at the edge of the network for faster response times and reduced latency. Overall, AI is set to continue transforming the industrial sector, with applications ranging from quality control to supply chain optimization and intelligent robotics.

How is this market segmented and which is the largest segment?

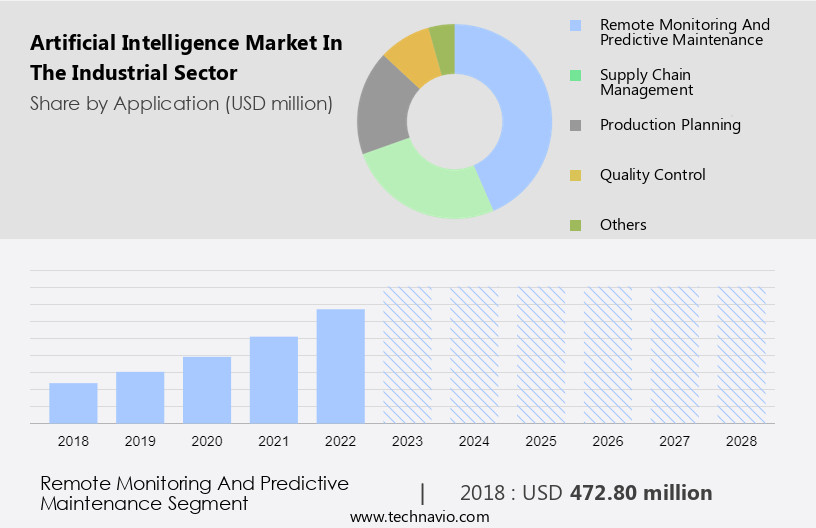

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Remote monitoring and predictive maintenance

- Supply chain management

- Production planning

- Quality control

- Others

- End-user

- Process industries

- Discrete industries

- Geography

- North America

- US

- APAC

- China

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- North America

By Application Insights

- The remote monitoring and predictive maintenance segment is estimated to witness significant growth during the forecast period.

Artificial Intelligence (AI) is revolutionizing the industrial sector by enhancing efficiency, productivity, and safety. Big Data, machine learning, speech processing, generative AI, robotics, computer vision, and natural language processing are some of the key technologies driving this transformation. In industrial machines and smart machines, AI enables real-time monitoring, predictive maintenance, and process optimization. Computer vision and machine learning are used for quality control, supply chain optimization, and intelligent robotics. Autonomous vehicles and guided systems are revolutionizing transportation and logistics, while energy management and human-machine interfaces are transforming the energy sector. AI-powered virtual assistants, deep learning search algorithms, and recommendation systems are disrupting financial services, healthcare, and travel and hospitality.

Moreover, AI is essential for cybersecurity, energy management, and process optimization in various industries. With the proliferation of IoT devices, AI is becoming increasingly important for central processing units and semiconductor manufacturing. The adoption of AI solutions is expected to reduce maintenance costs, minimize safety hazards, and enhance overall operational excellence.

Get a glance at the market report of share of various segments Request Free Sample

The remote monitoring and predictive maintenance segment was valued at USD 472.80 million in 2018 and showed a gradual increase during the forecast period.

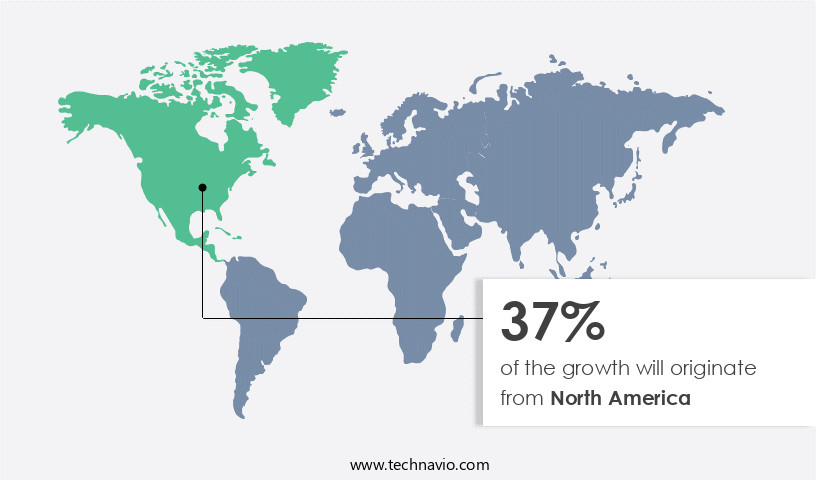

Regional Analysis

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The artificial intelligence (AI) market in the industrial sector in North America is poised for significant growth, driven by advancements in technologies such as field-programmable gate arrays (FPGAs), application-specific integrated circuits (ASICs), graphics processing units (GPUs), and AI. Big data analytics, robotics, and AI-generated content are key applications. ChatGPT and AI art generators are revolutionizing content creation, while Federated Learning and explainable AI enhance decision-making.

Additionally, edge AI and mid-term roadmaps focus on federated optimization algorithms and machine learning techniques like natural language processing. Digital data from sensors, social media platforms, online transactions, and industry-wide standards fuel this exponential growth. The reshoring of manufacturing from overseas to North America and the establishment of smart factories to ensure proximity to end-users and customization are significant factors. Data cleaning, preprocessing, validation processes, and data sharing collaborations are crucial for data collection and preprocessing capabilities.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Artificial Intelligence Market in the Industrial Sector?

Digital twin technology is gaining traction in industries and is the key driver of the market.

- Artificial Intelligence (AI) is revolutionizing the industrial sector by enhancing the capabilities of industrial machines through technologies like Big Data, machine learning, speech processing, generative AI, robotics, computer vision, and natural language processing. AI is being integrated into various industries such as technology and communication, transportation and logistics, financial services, healthcare, energy, travel and hospitality, and manufacturing. In manufacturing, AI is used for real-time monitoring, quality control, supply chain optimization, intelligent robotics, and energy management. Digital twin technology, a subset of AI, is gaining popularity by creating virtual replicas of physical assets or processes, enabling real-time data analysis and simulation capabilities.

- Additionally, this leads to predictive behavior, improved decision-making, and performance optimization. Digital twins are utilized in industries like automotive to optimize vehicle designs before physical prototypes are built. AI algorithms, including deep learning, search algorithms, recommendation systems, and adtech networks, analyze data from digital twins to identify opportunities for product optimization, customization, and innovation. The integration of AI in industrial processes also enhances human-machine interfaces, food processing, mining, semiconductor manufacturing, and IoT devices, while addressing data proliferation and cybersecurity concerns through process optimization and central processing units.

What are the market trends shaping the Artificial Intelligence Market in the Industrial Sector?

The emergence of IIoT is the upcoming trend in the market.

- The Industrial Artificial Intelligence (AI) market is witnessing significant growth due to the integration of Big Data, machine learning, speech processing, generative AI, robotics, computer vision, and natural language processing in various industries. Technology and communication, transportation and logistics, financial services, healthcare, energy, travel and hospitality, and manufacturing sectors are adopting AI to enhance process optimization, quality control, and supply chain management. AI technologies such as machine learning, deep learning, search algorithms, recommendation systems, and adtech networks are being utilized in real-time monitoring, intelligent robotics, autonomous vehicles, energy management, and human-machine interfaces.

- Furthermore, the proliferation of IoT devices and data is fueling the demand for AI in industries like food processing, mining, semiconductor manufacturing, and cybersecurity. Additionally, companies are offering services, control modules, and user-friendly graphical user interfaces (GUIs) for remote control and operation flexibility. AI is revolutionizing industrial machines and processes, making them smarter and more efficient.

What challenges does Artificial Intelligence Market in the Industrial Sector face during the growth?

Lack of technical knowledge among operators is a key challenge affecting the market growth.

- Artificial Intelligence (AI) is revolutionizing various sectors of the industrial industry, including Big Data, machine learning, speech processing, generative AI, robotics, computer vision, technology and communication, transportation and logistics, financial services, healthcare, energy, travel and hospitality, and more. AI technologies such as machine learning, deep learning, search algorithms, recommendation systems, and adtech networks are being employed for real-time monitoring, quality control, supply chain optimization, intelligent robotics, autonomous vehicles, guided systems, energy management, human-machine interfaces, food processing, mining, semiconductor manufacturing, and more.

- However, the adoption of AI in the industrial sector faces challenges, particularly the lack of technical expertise among the workforce. Manufacturers implementing AI require a solid understanding of AI software platforms and their maintenance requirements to ensure seamless operations. This technical knowledge gap deters many end-users, particularly in developing countries, from adopting AI. To succeed in the market, companies must invest in online and offline training and consultation services to support end-users with limited technological familiarity. The proliferation of IoT devices and data, cybersecurity concerns, and process optimization are also crucial areas of focus for AI companies in the industrial sector.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Amazon.com Inc.

- Aquant

- Automation Anywhere Inc.

- FANUC Corp.

- H2O.ai Inc.

- Intel Corp.

- International Business Machines Corp.

- Landing AI

- Micron Technology Inc.

- Microsoft Corp.

- Mitsubishi Electric Corp.

- NVIDIA Corp.

- Oracle Corp.

- Rockwell Automation Inc.

- SAP SE

- Siemens AG

- Sight Machine

- Wipro Ltd.

- General Electric Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Artificial Intelligence (AI) is revolutionizing various industries by enabling advanced automation, data analysis, and decision-making capabilities. Big data, machine learning, and deep learning are the core technologies driving the AI market in sectors like transportation and logistics, financial services, healthcare, energy, travel and hospitality, and manufacturing. AI applications include machine learning algorithms for predictive maintenance in industrial machines, real-time monitoring and process optimization, and intelligent robotics for manufacturing and mining. In the industrial sector, AI technologies such as computer vision, speech processing, natural language processing, and generative AI are used for quality control, supply chain optimization, energy management, and human-machine interfaces.

In summary, AI is also transforming industries like food processing and semiconductor manufacturing through automation and process optimization. Moreover, the proliferation of IoT devices and data has led to an increased focus on cybersecurity and data privacy in the AI market. AI technologies like machine learning, search algorithms, recommendation systems, and adtech networks are being used to enhance customer experiences and improve operational efficiency. The future of AI in industry will see the integration of AI in various applications, from autonomous vehicles to intelligent energy management systems.

|

Artificial Intelligence Market in the Industrial Sector Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 38.86% |

|

Market growth 2024-2028 |

USD 29.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

35.89 |

|

Key countries |

US, Saudi Arabia, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch