Europe - Aluminum Wire Rods Market 2024-2028

The Europe - Aluminum Wire Rods Market size is estimated to grow at a CAGR of 5.54% between 2023 and 2028, with the market size forecast to increase by USD 1.17 billion.

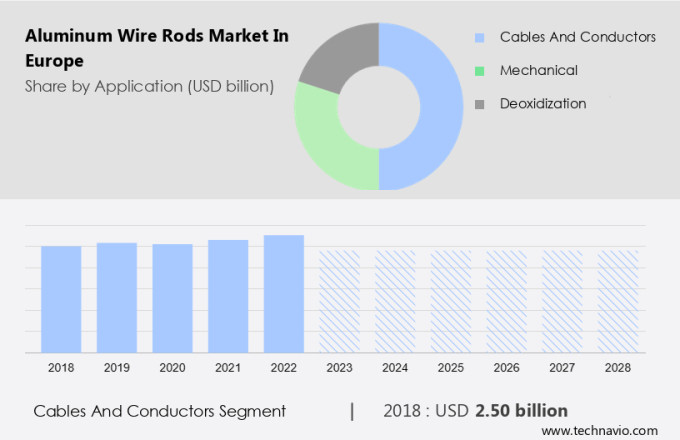

The report includes a comprehensive outlook on the Europe Aluminum Wire Rods Market offering forecasts for the industry segmented by Application, which comprises cables and conductors, mechanical, and deoxidization. Additionally, it categorizes Grade Type into electrical and alloy and covers Region, including North America, APAC, Europe, Middle East and Africa, and South America. The report provides market size, historical data spanning from 2018 to 2022, and future projections, all presented in terms of value in USD billion for each of the mentioned segments.

The growth of the market is propelled by the increase in steel production in Europe, although its progress is hindered by the low-cost imports from China. Furthermore, there is a notable upward trend including the rise in HVDC cable installations.

What will be the size of the Europe Aluminum Wire Rods Market During the Forecast Period?

To learn more about this report, Request Free Sample

Europe Aluminum Wire Rods Market Definition

Aluminum wire rods are made from liquid aluminum. The diameter of these rods is reduced by extruding them through a series of dies to obtain a diameter of 9-32 millimeters (mm) by roller and drawing processes. Aluminum wire rods are used in applications such as cables and conductors due to their high electrical conductivity, lightweight, and resistance to corrosion. These rods are mainly used in the electric utility segment for power transmission and distribution applications. Aluminum wire rods do not face any stiff competition from other metals for transmission and distribution applications owing to their cost advantages.

Europe Aluminum Wire Rods Market Segment Insights

Application Insights

The cables and conductors segment is estimated to witness significant growth during the forecast period. Aluminium wire rods are used to manufacture a wide range of cables and conductors due to their low costs and high electrical conductivity. Aluminum wire rods are largely preferred for power cables, overhead conductors, and overhead power lines due to their excellent electrical and mechanical properties.

Get a glance at the market contribution of various segments View the PDF Sample

The cables and conductors were the largest segment and were valued at USD 2.50 billion in 2018. Aluminum conductors are typically produced using aluminum wire rods. Generally, these conductors contain about 99.5% aluminum and are made of one or more strands of aluminum wires, depending on their end-use applications. These conductors are primarily used in the transmission and distribution sector in applications such as overhead lines. Aluminum conductors are known for their tensile strength, corrosion resistance, and shockproof properties. They are widely used in urban areas for short-space applications. The increasing focus on the expansion of power networks and the broadening of renewable energy sources such as the installation of offshore and onshore wind energy farms, are likely to drive the demand for aluminum wire rods in the cables and conductors application segment, thereby driving the market growth during the forecast period.

Grade Type Insight

Based on the grade type, the market has been segmented into electrical and alloys. The electrical segment will account for the largest share of this segment.?

Europe Aluminum Wire Rods Market: Key Drivers, Trends, and Challenges

An increase in steel production in Europe is notably driving the market growth. Steel is one of the essential commodities that contribute substantially to Europe's economic growth. The construction industry has been a key contributor to the growth of the Europe - aluminum wire rods market. Further, aluminum wire rod products are widely used to produce steel. They are deoxidization agents and help in removing the oxygen content during the steelmaking process. The steel deoxidization process enhances the quality of steel produced and makes it blowholes-free. Aluminum oxide produced during this process ensures durability and provides strength to steel. Therefore, the increase in the production of steel in Europe is expected to significantly boost the market growth during the forecast period.

The rise in HVDC cable installations is an emerging trend shaping the market growth. High-voltage direct current (HVDC) cables are a highly efficient medium for transmitting large volumes of electrical power for special-purpose applications and over long distances. Furthermore, the HVDC uses high-temperature cables that are made of both standard steel or aluminum conductors and high-temperature superconductor materials that enable cables to operate at higher temperatures than standard steel or aluminum cables. Compared to HVDC, cables made of standard conductors heat up very fast if a high-voltage current is passed through them. Therefore, owing to the superior performance of HVDC cables, their adoption is increasing, which in turn will positively affect the market growth during the forecast period.

Low-cost imports from China are a significant challenge hindering the market growth. China is one of the largest producers and consumers of aluminum. In 2021, China produced more than 38.8 million metric tons of aluminum. Furthermore, the easy availability of low-cost raw materials and labor has a positive influence on the aluminum industry in China. Europe is focusing on decreasing its carbon footprint and progressing toward its low-carbon economy goals. This discourages aluminum wire rod manufacturers in the region compared with Chinese aluminum wire rod manufacturers. Due to the above-mentioned factors, price competition from Chinese suppliers might become one of the major challenges faced by aluminum wire rod manufacturers in Europe if the region does not proactively implement anti-dumping measures against China. Hence, the low-cost imports from China is expected to hamper the growth of the market during the forecast period.

Who are the Major Europe Aluminum Wire Rods Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alcoa Corp - The company offers aluminum wire rods under its brand SUSTANA.

The research report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including Alcoa Corp., Asturiana de Aleaciones S.A., Hindalco Industries Ltd., INOTAL Alumíniumfeldolgozo Zrt., Lamifil NV, LONTANA S.A., National Aluminium Co. Ltd., Nexans SA, Norsk Hydro ASA, NPA Skawina Sp. z o.o., Prysmian Spa, TRIMET Aluminium SE, United Company RUSAL, Vedanta Ltd, Vimetco NV, and Zvetlit

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Europe Aluminum Wire Rods Market Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Europe Aluminum Wire Rods Market Customer Landscape

| Europe Aluminum Wire Rods Market Scope | |

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.54% |

|

Market Growth 2024-2028 |

USD 1.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.72 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alcoa Corp., Asturiana de Aleaciones S.A., Hindalco Industries Ltd., INOTAL Alumíniumfeldolgozo Zrt., Lamifil NV, LONTANA S.A., National Aluminium Co. Ltd., Nexans SA, Norsk Hydro ASA, NPA Skawina Sp. z o.o., Prysmian Spa, TRIMET Aluminium SE, United Company RUSAL, Vedanta Ltd, Vimetco NV, and Zvetlit |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Europe Aluminum Wire Rods Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across Europe

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.