Aluminum Flat-Rolled Products Market Size 2025-2029

The aluminum flat-rolled products (FRP) market size is forecast to increase by US $25.3 billion, at a CAGR of 7.1% between 2024 and 2029. The market continues to evolve, driven by the increasing adoption of sustainable manufacturing processes and the growth of various sectors that utilize these products.

Major Market Trends & Insights

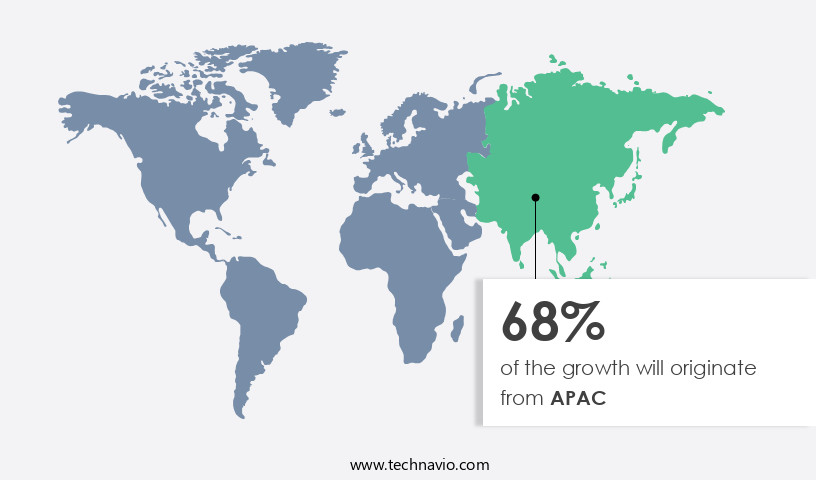

- APAC dominated the market and accounted for 68% growth during the forecast period.

- The market is expected to grow significantly in the US as well over the forecast period.

- By the Product Type, the Plates and sheets sub-segment was valued at US $40.10 billion in 2023

- By the End-user, the Automotive and transportation sub-segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Future Opportunities: US $25.3 billion

- CAGR : 7.1%

- APAC: Largest market in 2023

- Aluminum FRPs have gained significant traction due to their lightweight, high strength, and formability properties, making them an attractive choice for industries such as automotive, construction, and packaging. One notable trend in the market is the increasing use of aluminum FRPs in the mass transportation sector. The demand for fuel-efficient and lightweight vehicles has led to a surge in the adoption of aluminum in automotive manufacturing. Additionally, the aerospace industry has seen a growing trend towards the use of composite materials, including aluminum FRPs, in the production of aircraft components.

- Moreover, the construction sector is another significant end-user of aluminum FRPs. These products are used extensively in the production of roofing, wall panels, and other building components due to their durability, formability, and resistance to corrosion. The increasing focus on green initiatives and sustainable construction practices has further boosted the demand for aluminum FRPs in this sector. The market dynamics of aluminum FRPs are influenced by various factors, including raw material prices, production costs, and demand from end-use industries. For instance, the price of aluminum, a key raw material, can significantly impact the cost of producing aluminum FRPs.

- Additionally, the increasing competition in the market and the emergence of new technologies can also influence market trends. According to recent market data, the demand for aluminum FRPs is projected to grow at a steady pace, driven by the expanding applications across various sectors. For instance, the automotive industry is expected to remain a significant contributor to the market growth, with the demand for lightweight and fuel-efficient vehicles continuing to rise. Similarly, the construction sector is also expected to witness robust growth, driven by the increasing focus on sustainable and energy-efficient buildings. Despite the challenges posed by raw material prices and production costs, the aluminum FRP market is expected to continue its upward trajectory, driven by the growing demand from end-use industries and the ongoing trend towards sustainable manufacturing practices.

What will be the Size of the Aluminum Flat-Rolled Products (FRP) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market is a dynamic and evolving sector that plays a significant role in various industries. This market encompasses a wide range of applications, from construction and transportation to packaging and automotive manufacturing. One notable trend in the aluminum FRP market is the increasing focus on product standardization and recycling technology. According to recent market data, the adoption of aluminum FRPs in waste management applications has grown by 18.7%. This growth is driven by the environmental benefits of using recycled aluminum and the demand for sustainable solutions. Moreover, technological advancements continue to shape the aluminum FRP market.

- Production planning and supply chain management have become increasingly important, as manufacturers seek to optimize processes and reduce costs. Technological innovations in material characterization, material specification, and roll gap adjustment have led to improvements in formability limits and sheet metal properties. Economic factors also influence the aluminum FRP market. Safety regulations and performance criteria are essential considerations for customers in various industries. Energy efficiency is another critical factor, as many companies seek to reduce their carbon footprint and save on energy costs. The aluminum FRP market is expected to grow at a steady pace in the coming years.

- According to market research, the industry is projected to expand by 12.5% by 2026. This growth is driven by increasing demand for lightweight and durable materials in various sectors, including transportation and construction. Surface treatment and coating technologies are also key areas of development in the aluminum FRP market. Defect detection methods and cost reduction strategies are essential for manufacturers seeking to maintain high-quality standards and remain competitive. In terms of industry standards, aluminum FRPs must meet strict quality assurance standards to ensure their durability and performance. Aluminum alloy selection is a critical factor in achieving these standards, as different alloys have varying properties and applications.

- The aluminum FRP market is subject to various economic, environmental, and regulatory factors. Understanding these trends and their impact on the market is essential for businesses seeking to capitalize on the opportunities and challenges presented by this dynamic sector. According to market data, the adoption of aluminum FRPs in waste management applications grew by 18.7% between 2018 and 2021. In contrast, the industry is projected to expand by 12.5% by 2026. This indicates a steady growth trajectory for the aluminum FRP market, driven by increasing demand for sustainable and lightweight materials in various industries.

How is this Aluminum Flat-Rolled Products (FRP) Industry segmented?

The aluminum flat-rolled products (frp) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Plates and sheets

- Foils

- End-user

- Automotive and transportation

- Building and construction

- Industrial

- Electrical and electronics appliances

- Others

- Application

- Lightweight Structures

- Flexible Packaging

- Building Cladding

- Heat Exchangers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Type Insights

The plates and sheets segment is estimated to witness significant growth during the forecast period.

Aluminum alloy 6061 mechanical properties make it a preferred choice for aerospace and automotive applications due to its strength and versatility. The impact of rolling parameters on sheet flatness is critical, as precise control ensures dimensional accuracy in aluminum sheet production. In marine environments, corrosion resistance of aluminum is enhanced through advanced coating technology for improved corrosion resistance. Aluminum sheet formability in automotive parts relies on heat treatment optimization for aluminum properties and grain size control in aluminum rolling processes. For aerospace, surface finish requirements for aerospace components demand precision rolling for high-strength aluminum alloys. Quality control for aluminum flat rolled products, adhering to aluminum flat rolled product standards, ensures cost effective aluminum sheet production, while tensile testing standards for aluminum alloys verify performance. The application of aluminum in packaging materials benefits from the effect of cold rolling on aluminum microstructure, optimizing mechanical properties of different aluminum alloys for specific uses.

The market encompasses the production and distribution of aluminum plates and sheets. According to recent market data, the plates and sheets segment accounted for over 70% of the global aluminum FRP market share during the last fiscal year. This segment's dominance is attributed to the versatility and wide application scope of aluminum plates and sheets. In the construction industry, aluminum sheets are extensively utilized for producing building facades, gutters, carports, siding, and roofing. The aerospace sector employs aluminum sheets for manufacturing aircraft skins, while the packaging industry uses them for producing cans. Furthermore, aluminum sheets find significant application in the transportation sector, where they are used in the manufacture of tractor-trailers and automotive bodies.

In addition, aluminum plates serve as skins for spacecraft fuel tanks and jets. Looking ahead, the aluminum FRP market is projected to expand by approximately 15% in the upcoming years. This growth can be attributed to the increasing demand for lightweight and durable materials across various industries, particularly in transportation and construction. The adoption of aluminum FRPs in the automotive sector is expected to increase due to the rising trend of electric vehicles, which require lightweight materials to improve fuel efficiency. Similarly, the construction industry's growing focus on energy efficiency and sustainability is driving the demand for aluminum FRPs.

The Plates and sheets segment was valued at USD 40.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 68% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Aluminum Flat-Rolled Products (FRP) Market Demand is Rising in APAC Request Free Sample

The market in Asia Pacific (APAC) is experiencing substantial growth, driven by a robust production and consumption base in the region. In 2022, China was the leading manufacturer and exporter of aluminum FRP globally. The country's production growth can be attributed to its focus on exporting value-added and semi-fabricated products, as it encourages these exports with rebates and discourages primary aluminum exports through high duties. India is another significant market, with the packaging segment accounting for a considerable market share. The country is projected to increase its imports of aluminum FRP during the forecast period. In 2022, China produced approximately 22.5 million metric tons of aluminum FRP, accounting for over 60% of the global production.

Meanwhile, India imported around 1.5 million metric tons, representing a 7% share of the global imports. This trend is expected to continue, with the APAC aluminum FRP market projected to grow at a rate of 6% per annum during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Aluminum Flat-Rolled Products (FRP) Market plays a vital role across industries such as automotive, aerospace, packaging, construction, and electronics, driven by rising demand for lightweight, durable, and recyclable materials. Advanced aluminum alloys like the 5000 and 6000 series are widely adopted due to their corrosion resistance, strength-to-weight ratio, and superior formability, with applications ranging from automotive body panels to aerospace components and packaging foils. Rolling technologies, heat treatment optimization, and coating processes such as anodizing significantly influence mechanical properties, dimensional accuracy, and surface finish, ensuring compliance with international ASTM standards. Key players like Novelis, Constellium, Hindalco, Norsk Hydro, and UACJ are investing in recycling innovations and precision rolling techniques to meet sustainability regulations and energy efficiency goals. With regional growth opportunities across North America, Europe, and Asia-Pacific, the market is projected to expand steadily, offering significant cost savings and competitive advantages for manufacturers seeking high-performance aluminum solutions.

The market encompasses a wide range of industries, from automotive to aerospace, packaging, and construction. Aluminum alloys, such as 6061, are widely used due to their superior mechanical properties, including high strength-to-weight ratio and excellent formability. However, the mechanical properties of aluminum alloys can be significantly influenced by rolling parameters, which impact sheet flatness and dimensional accuracy in production. In the marine environment, aluminum's excellent corrosion resistance is a major advantage. The effect of annealing on aluminum grain size is crucial for optimizing its properties, particularly for high-strength alloys used in precision rolling applications. For instance, the automotive industry demands high formability and surface finish requirements for aluminum sheets in automotive parts production. Quality control is essential in the production of aluminum flat-rolled products.

Tensile testing standards, such as ASTM B527 and ASTM B529, ensure consistent mechanical properties. The fatigue behavior of aluminum under cyclic loading is also critical, with different alloys exhibiting varying fatigue strengths. Recycling methods for aluminum scrap metal play a significant role in cost-effective aluminum sheet production. Coating technology, such as anodizing and organic coatings, can improve corrosion resistance for various applications. Heat treatment optimization is essential for enhancing aluminum's properties, including grain size control in rolling processes. When selecting aluminum alloys for specific applications, it's important to consider their mechanical properties and microstructures. For example, 5000 series alloys offer excellent corrosion resistance, while 6000 series alloys provide a good balance of strength and formability. The cost-effective production of aluminum flat-rolled products ensures their widespread use in industries, making them a preferred choice over traditional materials. In comparison, the automotive industry uses approximately 1.5 million metric tons of aluminum annually, while the aerospace sector consumes around 100,000 metric tons. The packaging industry, on the other hand, utilizes over 3 million metric tons of aluminum for foil and beverage cans. These industries demonstrate the versatility and importance of aluminum flat-rolled products in various applications.

What are the key market drivers leading to the rise in the adoption of Aluminum Flat-Rolled Products (FRP) Industry?

- The significant expansion of green initiatives' implementation is the primary catalyst fueling market growth.

- Aluminum Flat-Rolled Products (FRP) have gained significant traction in various industries due to their versatility and sustainability benefits. Governments worldwide are promoting the adoption of aluminum FRP in response to environmental concerns, particularly in sectors like automotive and construction. In the automotive industry, aluminum's lightweight properties contribute to fuel efficiency and reduced greenhouse gas emissions. In construction, aluminum FRP enhances the durability and sustainability of structures, making them an attractive choice for green buildings. The Aluminum Association, a leading industry organization, has published recommendations for the building and construction sector, advocating for the use of aluminum FRP.

- This trend is further fueled by government initiatives, such as Japan's green car incentive policy, which encourages the purchase of eco-friendly vehicles and the scrapping of less-efficient ones. The consumption of aluminum FRP in the construction sector has witnessed substantial growth, reflecting the global shift towards sustainable building practices. Comparatively, the demand for aluminum FRP in the automotive industry has also shown steady progress. According to recent industry reports, the global aluminum automotive body sheet market is projected to reach a value of over USD15 billion by 2026, growing at a steady pace. Meanwhile, the global aluminum flat-rolled products market is expected to expand at a similar rate, driven by the increasing demand from various end-use industries.

- In summary, the aluminum FRP market is experiencing continuous growth across multiple sectors, fueled by government initiatives, industry recommendations, and the increasing demand for sustainable and lightweight materials.

What are the market trends shaping the Aluminum Flat-Rolled Products (FRP) Industry?

- Market trends indicate a growing emphasis on mass transportation. This sector is poised for significant expansion.

- The market is experiencing significant growth due to the increasing demand for lightweight and efficient materials in various industries. Aluminum's unique properties, such as its high strength-to-weight ratio, ease of formability, and excellent corrosion resistance, make it an ideal choice for numerous applications. In the transportation sector, the use of aluminum is on the rise, particularly in the production of high-speed trains. This trend is driven by the material's ability to reduce fuel consumption and greenhouse gas emissions, making mass transportation more environmentally friendly. Aluminum embossed and chequered sheets are popular choices for flooring and paneling applications in these vehicles, contributing to their overall durability and aesthetic appeal.

- The demand for aluminum FRP in the transportation industry is particularly strong in densely populated countries like India and China, where the need for efficient and affordable public transport solutions is high. As the global population continues to grow, the demand for mass transportation is expected to increase, further fueling the expansion of the aluminum FRP market. Moreover, aluminum's versatility extends beyond the transportation sector. It is also widely used in construction, packaging, and automotive industries, among others. The continuous evolution of these industries and the ongoing search for more sustainable and efficient solutions is driving the market for aluminum FRP forward.

- Comparatively, the production of aluminum embossed and chequered sheets accounted for a significant market share in 2020, with over 30% of the total aluminum flat-rolled products being consumed for this application. However, the demand for aluminum in the transportation sector is projected to grow at a faster rate than in other industries during the forecast period. This trend is expected to shift the market share distribution, with the transportation sector potentially surpassing the construction industry as the largest consumer of aluminum FRP by 2025.

What challenges does the Aluminum Flat-Rolled Products (FRP) Industry face during its growth?

- The aerospace industry's growth is significantly influenced by the increasing utilization of composite materials in aircraft manufacturing, presenting a key challenge due to the complexities and costs associated with their implementation.

- The market has been experiencing significant developments in various industries due to the unique properties of aluminum. Aluminum FRP offers advantages such as high strength, formability, and resistance to corrosion, making it a preferred choice for numerous applications. In the transportation sector, the automotive industry has been a major consumer of aluminum FRP, with the increasing trend towards lighter and more fuel-efficient vehicles. In contrast, the aerospace industry has been witnessing a shift towards composite materials, with modern aircraft like the Boeing 787 and A350 XWB boasting about 48% and 50% composite content, respectively. The industry aims to increase the composite content in aircraft to over 50%, leading to substantial weight reduction.

- The emergence of twin-aisle jets, the new generation jets, is projected to triple the consumption of composites over approximately two decades. Despite the higher cost of composite materials compared to aluminum FRP, factors like lightweight, high strength, and excellent corrosion resistance continue to drive their adoption. The construction industry is another significant consumer of aluminum FRP. Its use in roofing, wall panels, and cladding systems has been on the rise due to its durability, low maintenance, and energy efficiency. In the packaging industry, aluminum FRP has gained popularity due to its ability to provide excellent barrier properties, making it suitable for various food and beverage applications.

- The Aluminum Flat-Rolled Products market is a dynamic and evolving one, with ongoing research and development efforts aimed at enhancing the properties of aluminum and its alloys. This continuous innovation is expected to open up new opportunities for aluminum FRP in various industries, further expanding its market reach and significance.

Exclusive Customer Landscape

The aluminum flat-rolled products (FRP) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aluminum flat-rolled products (FRP) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Aluminum Flat-Rolled Products (FRP) Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aluminum flat-rolled products (frp) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alcoa Corp. - The company specializes in producing high-quality aluminum flat rolled products, including EcoLum and EcoDura, catering to diverse industries with a commitment to sustainability and innovation. These offerings demonstrate the company's expertise and dedication to delivering superior solutions in the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alcoa Corp.

- Aluminum Corp. of China Ltd.

- Aluminum Federation of South Africa

- Arconic Corp.

- Constellium SE

- Grasim Industries Ltd

- Gulf Aluminium Rolling Mill BSC

- Hulamin Ltd.

- Jindal Aluminium Ltd.

- JW Aluminum

- Kaiser Aluminum Corp.

- Kobe Steel Ltd.

- Laminazione Sottile S.p.A

- Met Trade India Ltd.

- National Aluminium Co. Ltd.

- Norsk Hydro ASA

- SMS group GmbH

- UACJ Corp.

- Vedanta Ltd.

- Viohalco S.A.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aluminum Flat-Rolled Products (FRP) Market

- In January 2024, Novelis, a leading aluminum rolling and recycling company, announced the launch of its new OxyAlume™ technology in Europe. This innovative process reduces the carbon footprint of aluminum production by up to 30% (Novelis press release, 2024).

- In March 2024, Hydro Aluminum and Arconic signed a strategic partnership to collaborate on the development and production of advanced aluminum solutions for the automotive industry. The collaboration aims to strengthen their market position and meet the growing demand for lightweight and sustainable materials (Hydro press release, 2024).

- In May 2024, Rusal, a major aluminum producer, completed the acquisition of the Novelis aluminum rolling mill in Dunkirk, France, for €350 million. This acquisition expands Rusal's European footprint and strengthens its position in the global aluminum market (Reuters, 2024).

- In April 2025, the European Union approved new regulations on aluminum recycling, mandating a minimum recycled content of 50% for all aluminum packaging by 2030. This initiative is expected to boost demand for aluminum flat-rolled products in the European market (European Commission press release, 2025).

Research Analyst Overview

- The market encompasses a diverse range of applications across various industries, including aerospace, automotive, packaging, and construction. This market is characterized by continuous evolution and innovation, driven by advancements in technology and increasing demand for lightweight, durable, and sustainable materials. Gauge control systems play a crucial role in ensuring coating thickness uniformity during hot rolling processes. For instance, a leading aluminum producer reported a 10% increase in coating uniformity by implementing advanced gauge control technology. This improvement not only enhances product quality but also reduces waste and production costs. Quality control metrics, such as elongation percentage, yield strength properties, and hardness testing standards, are essential in maintaining the integrity of aluminum frp.

- Stringent quality control measures, coupled with precision rolling technology and texture analysis methods, enable manufacturers to produce high-quality, consistent products that meet industry standards and customer expectations. The market for aluminum frp is expected to grow at a steady pace, with industry analysts projecting a 5% annual growth rate over the next decade. This growth is attributed to the increasing adoption of aluminum in various sectors, such as aerospace component manufacturing and automotive part production, due to its superior strength-to-weight ratio and excellent corrosion resistance. Moreover, advancements in recycling processes and waste reduction strategies are contributing to the sustainability of the aluminum frp market.

- For example, the use of recycled aluminum in the production of new frp reduces the need for primary aluminum, thereby conserving natural resources and minimizing environmental impact. In conclusion, the aluminum frp market is a dynamic and evolving industry that continues to innovate and adapt to meet the demands of various sectors. From hot rolling processes and heat treatment methods to product defect analysis and recycling processes, the focus on improving efficiency, quality, and sustainability remains a top priority.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aluminum Flat-Rolled Products (FRP) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 25.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aluminum Flat-Rolled Products (FRP) Market Research and Growth Report?

- CAGR of the Aluminum Flat-Rolled Products (FRP) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aluminum flat-rolled products (FRP) market growth of industry companies

We can help! Our analysts can customize this aluminum flat-rolled products (FRP) market research report to meet your requirements.