Aluminum Composite Panels Market Size 2024-2028

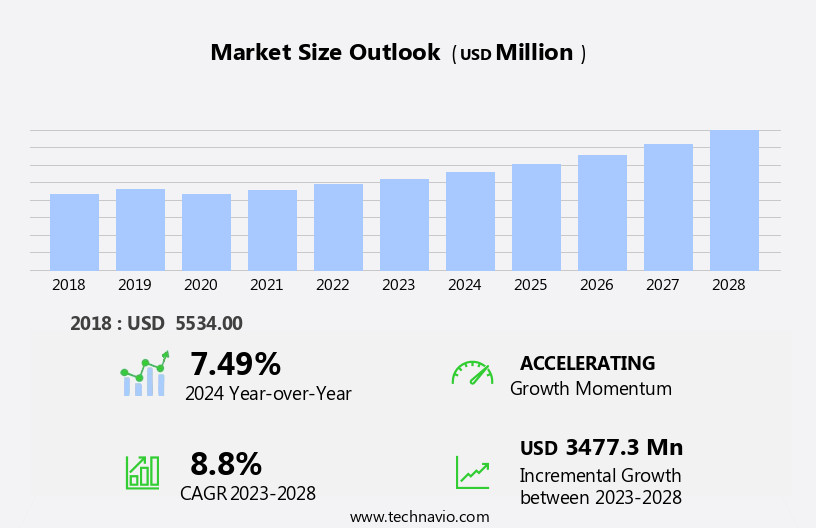

The aluminum composite panels market size is forecast to increase by USD 3.48 billion at a CAGR of 8.8% between 2023 and 2028.

What will be the Size of the Aluminum Composite Panels Market During the Forecast Period?

How is this Aluminum Composite Panels Industry segmented and which is the largest segment?

The aluminum composite panels industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Fire-resistant

- Antibacterial

- Antistatic

- End-user

- Building and construction

- Transportation

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Type Insights

- The fire-resistant segment is estimated to witness significant growth during the forecast period.

Aluminum Composite Panels (ACPs) have gained significant traction In the construction industry due to their lightweight, superior sealing, and high insulation properties. These features make ACPs an ideal choice for various applications, including transportation systems, aircraft, satellites, high-speed trains, and green buildings. ACPs offer high load performance and durability, making them suitable for use in extreme weather conditions and areas with high humidity and moisture. Fire safety is a critical concern in modern construction, and ACPs are now available in fire-resistant (FR) grades. These FR ACPs are manufactured using advanced technology and offer excellent thermal and acoustic insulation, corrosion resistance, and tensile strength.

The increasing number of fire incidents in non-residential buildings and non-building premises has led to stringent regulations regarding the use of fire safety materials in construction. As a result, the demand for FR ACPs is expected to grow significantly In the coming years. ACPs are also used for decorative cladding, signage, advertising boards, and mass media applications. Their flexibility and brand strength make them an ideal choice for various industries, including advertising, marketing, and mass media. The production capacity of ACP manufacturers is increasing to meet the growing demand, and customizations are also available to cater to specific customer requirements.

Overall, the revenue growth In the ACP market is expected to be natural, driven by the increasing need for lightweight materials, superior sealing, and high insulation in various industries.

Get a glance at the Aluminum Composite Panels Industry report of share of various segments Request Free Sample

The Fire-resistant segment was valued at USD 2.36 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 50% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth, primarily driven by the robust demand from the construction, automotive, and packaging industries in China and India. With increasing investments in infrastructure development In these countries, the construction sector is witnessing a surge in projects, including roads, dams, bridges, and urban infrastructure. According to the Department for Promotion of Industry and Internal Trade (DPIIT), India alone attracted USD26 billion in foreign direct investments (FDI) for construction development from April 2000 to September 2023. Lightweight and durable, aluminum composite panels offer superior sealing, high insulation, and resistance to humidity, moisture, temperature fluctuations, pollution, and corrosion.

These features make them an ideal choice for various applications, such as sandwich panels, transportation systems, and interior design. The market for these panels is further boosted by their high load performance, flexibility, and brand strength, making them suitable for use in aircraft, satellites, missiles, high-speed trains, green buildings, and LEED-certified projects. Additionally, aluminum composite panels can be customized with various laminating coatings, such as PVDF and PE, and are used for decorative cladding, advertising boards, signage, and revenue-generating opportunities in advertising, marketing, and mass media. The market's production capacity continues to expand, with companies offering product customizations and innovative solutions, such as Alumaze and Alucopanel, to cater to diverse customer needs.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Aluminum Composite Panels Industry?

Increasing use of lightweight materials in various end-user industries is the key driver of the market.

What are the market trends shaping the Aluminum Composite Panels Industry?

Increasing development of green buildings is the upcoming market trend.

What challenges does the Aluminum Composite Panels Industry face during its growth?

High volatility in LME prices of aluminum is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The aluminum composite panels market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aluminum composite panels market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aluminum composite panels market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Alcoa Corp. - Aluminum composite panels, including EcoLum, represent a significant market segment In the construction industry. These panels, which consist of two thin sheets of aluminum sandwiching a non-aluminum core, offer advantages such as durability, fire resistance, and ease of installation. The versatile nature of aluminum composite panels allows them to be used in various applications, including facade cladding, roofing, and interior linings. Their lightweight and high strength properties contribute to energy efficiency and cost savings in building projects. Additionally, the recyclability of aluminum makes these panels an environmentally friendly choice for architects and builders. The market is expected to grow due to increasing demand for sustainable and cost-effective building solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alcoa Corp.

- Alexia Panels Pvt. Ltd.

- Alstrong Enterprises India Pvt Ltd.

- Aludecor Lamination Pvt. Ltd.

- Alumax Panel Inc.

- Arconic Corp.

- Euro Panel Products Ltd.

- Fairfield Metal

- Hyundai Alcomax Co. Ltd.

- Jyi Shyang Industrial Co. Ltd.

- Mitsubishi Chemical Group Corp.

- MSENCO METAL CO. LTD

- Mulkholdings International

- ReynoArch India

- Schweiter Technologies AG

- Shanghai Huayuan New Composite Materials Co. Ltd.

- Sundow Polymers Co. Ltd.

- Viva Composite Panel Pvt. Ltd

- Wonder Alu Board

- zq steel group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Aluminum composite panels (ACPs) have gained significant traction in various industries due to their unique properties and benefits. These panels are known for their lightweight yet robust construction, making them an ideal choice for a multitude of applications. The primary features of ACPs include high insulation and superior sealing capabilities. The panels' thickness allows for effective temperature control, making them suitable for use in environments where maintaining consistent temperatures is crucial. Additionally, their flexibility and high load performance make them an excellent option for structures subjected to heavy loads or frequent movement. ACPs offer exceptional durability, ensuring they can withstand harsh conditions.

Their resistance to corrosion is a significant advantage, making them a preferred choice in humid and moisture-prone areas. Furthermore, ACPs provide excellent thermal and acoustic insulation, contributing to energy efficiency and noise reduction. The versatility of ACPs extends beyond their structural applications. In the realm of advertising and marketing, they are used to create eye-catching billboards and signage. Their decorative qualities make them a popular choice for interior design projects, while their brand strength and trademarked production processes ensure consistency and reliability. ACPs have a wide range of applications, from transportation systems and aircraft to satellites, missiles, and high-speed trains.

They are also increasingly being used in green buildings and those aiming for LEED certification due to their environmental benefits. The demand for ACPs continues to grow as industries recognize their advantages. Production capacity is expanding to meet the increasing demand, and product customizations are becoming more common to cater to specific client needs. Companies are investing in research and development to enhance the properties and applications of ACPs. Despite their numerous benefits, ACPs face challenges such as temperature fluctuations, pollution, and humidity. However, ongoing research and advancements in technology are addressing these issues, ensuring the continued growth and relevance of ACPs in various industries.

In summary, aluminum composite panels offer a multitude of benefits, including lightweight construction, high insulation, superior sealing, flexibility, durability, and resistance to corrosion. Their versatility and wide range of applications make them a valuable asset in various industries, from transportation to construction and advertising. The market for ACPs is growing, driven by increasing demand and ongoing research and development.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2024-2028 |

USD 3477.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.49 |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aluminum Composite Panels Market Research and Growth Report?

- CAGR of the Aluminum Composite Panels industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aluminum composite panels market growth of industry companies

We can help! Our analysts can customize this aluminum composite panels market research report to meet your requirements.