Agricultural Microbials Market Size 2025-2029

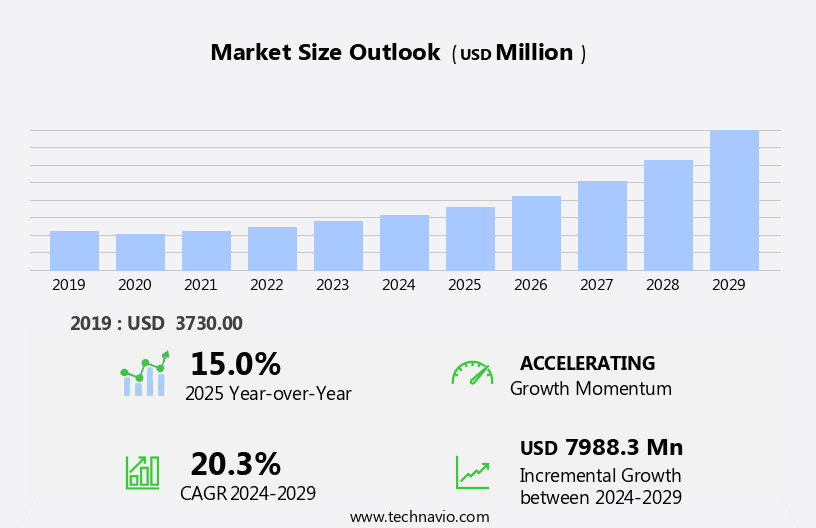

The agricultural microbials market size is forecast to increase by USD 7.99 billion at a CAGR of 20.3% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing adoption of organic farming practices and global initiatives to enhance agricultural output. Organic farming, which relies on the use of microbials for crop protection and soil health, is gaining popularity due to consumer demand for healthier and more sustainable food production methods. Furthermore, governments and international organizations are investing in research and development to improve agricultural productivity, making microbials an essential tool in modern farming. However, the market is also influenced by ecological considerations, such as greenhouse gas emissions and soil structures. Medium and small-sized enterprises are key players in the market, with many specializing in the production of soluble liquids for agricultural applications. Microbial products offer effective solutions for pest prevention and disease management under various climate conditions.

- This cost barrier may limit the market's growth potential in certain regions, particularly in developing countries. Additionally, the regulatory environment for microbial products can be complex and varied, requiring extensive testing and approval processes. Companies seeking to capitalize on market opportunities must navigate these challenges effectively by investing in research and development, building strategic partnerships, and focusing on cost-effective production methods. Overall, the market presents significant opportunities for growth, particularly in the organic farming sector, and companies that can address affordability and regulatory challenges will be well-positioned for success.

What will be the Size of the Agricultural Microbials Market during the forecast period?

- The market encompasses a range of products derived from microorganisms, including biologicals such as biopesticides, biofertilizers, and biostimulants. These innovative solutions enhance plant health, promote organic farming practices, and contribute to sustainable agriculture. Microbial derivatives, including bacterial strains and fungal applications, are used for seed treatment, foliar spray, and soil amendments. By improving pest resistance, nutrient uptake, and soil health, agricultural microbials offer an alternative to synthetic chemicals in crop protection.

- The market's growth is driven by the increasing demand for organic food products, environmental safety, and consumer preference for sustainable agriculture practices. Biostimulants improve plant growth and yield by enhancing nutrient uptake and promoting stress tolerance. Organic agriculture and conventional farming both benefit from the use of these microbial-based products, which can boost crop yield while minimizing environmental impact. The market's size and direction reflect the growing importance of plant health and food safety in global agriculture.

How is the Agricultural Microbials Industry segmented?

The agricultural microbials industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Crop Type

- Cereals and grains

- Oilseeds and pulses

- Fruits and vegetables

- Others

- Type

- Soil amendment

- Crop protection

- Product Specification

- Bacteria

- Fungi

- Virus

- Protozoa

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- North America

By Crop Type Insights

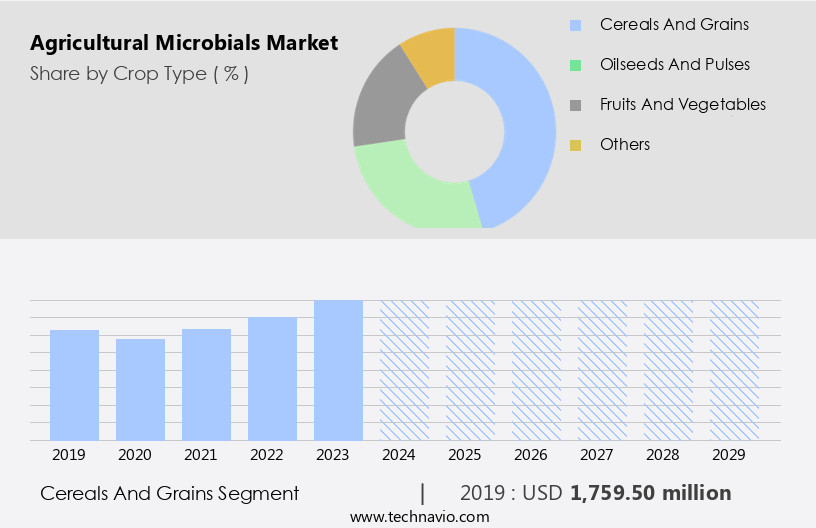

The cereals and grains segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the increasing global population and the demand for sustainable farming practices. By 2050, the Food and Agriculture Organization (FAO) predicts that there will be nine billion people on the planet, necessitating an increase in food production. This demand is driving the need for crop intensification, which involves increasing yields per acre while pursuing sustainable practices. Additionally, public concerns over food safety and environmental impact have led to the adoption of microbial products as biological substitutes for synthetic fertilizers and pesticides. These products can help mitigate biotic stress, such as plant pests and diseases, as well as abiotic stress, such as salts and nutrient imbalances, in the soil.

Microbial products are also effective in pest prevention and resistance, reducing the need for chemical pesticides and contributing to agricultural sustainability. The market for agricultural microbials includes soluble liquids, commercial formulation types, and seed treatments for various crops, including cereals and grains, oilseeds and pulses, fruits and vegetables, horticulture crops, and sugarcane. Market demand is further driven by the need to address climate conditions and the yield gap, as well as the desire to reduce greenhouse gas emissions. Medium and small-sized enterprises are key players in the market, offering a range of microbial products and solutions.

Get a glance at the market report of share of various segments Request Free Sample

The Cereals and grains segment was valued at USD 1.76 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

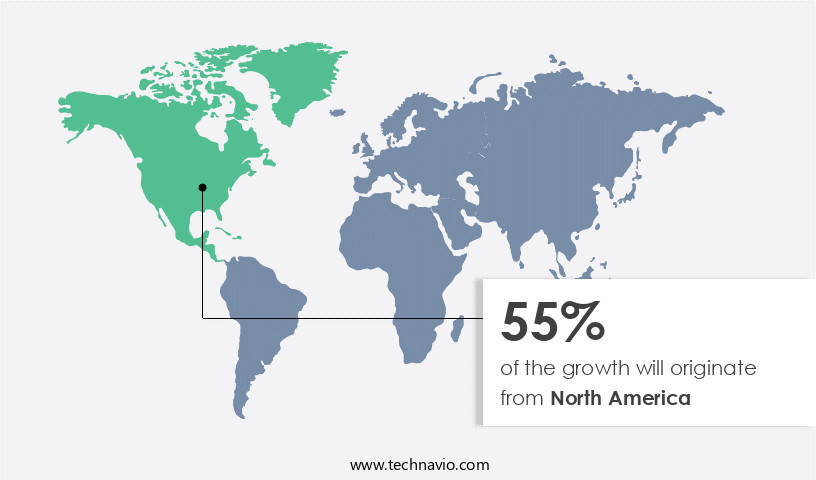

North America is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing significant growth due to the increasing adoption of organic farming practices and the conversion of conventional farms to organic. High-value crops are being grown more frequently, leading farmers to seek out microbial solutions for environmental benefits. Government investment in the region is essential to meet the population's needs, driving demand for microbiological solutions. Consumer concerns regarding food safety and quality are also increasing, further boosting market growth. Agricultural microbials offer effective pest prevention and resistance, as well as soil enhancement through the use of lactic acid bacteria, soil bacteria, and viable microorganisms.

Furthermore, the population in North America is becoming increasingly health-conscious and food safety-focused, leading to a greater emphasis on the use of microbial products for storage requirements and nutrient enhancement. Filamentous fungi, yeast, and other microbial strains are being extensively researched to create additional biological solutions for various agricultural applications. The governments in the region are also investing more in agricultural research to meet the growing food demand and ensure food safety, further fueling the market growth. Overall, the market in North America is poised for continued expansion, driven by the need for sustainable and effective crop protection products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Agricultural Microbials Industry?

- The growing adoption of organic farming is the key driver of the market. The global agricultural landscape is undergoing a shift towards more sustainable farming practices due to the increasing awareness of the health hazards associated with the use of chemicals in food production. The pressure on land and natural resources, coupled with the accelerated rate of crop production, results in the rapid loss of plant nutrients. Consequently, farmers have been relying heavily on inorganic fertilizers to replenish the soil. However, excessive use of these fertilizers can decelerate biological activities in the soil, leading to impaired soil quality. In response, the organic farming industry is experiencing growth as farmers seek more sustainable options.

- Organic farming avoids the use of synthetic fertilizers, pesticides, and genetically modified organisms (GMOs), making it a healthier and more environmentally friendly alternative. This trend is expected to continue as consumers become more conscious of their food choices and demand for healthier and more sustainable food options increases. The organic farming market is poised for significant growth as farmers and consumers alike recognize the long-term benefits of this sustainable farming approach.

What are the market trends shaping the Agricultural Microbials Industry?

- Global initiatives to improve agricultural output are the upcoming market trend. The global agricultural sector faces the challenge of feeding a growing population while ensuring food safety and security. The Food and Agriculture Organization (FAO) plays a crucial role in this regard, focusing on the sustainable management of natural resources to maximize agriculture's contribution to national economies. FAO's Regional Initiative supports countries in managing their resources sustainably, addressing climate change, and mitigating risks to agriculture, forestry, and fisheries. This necessitates the implementation of stringent quality standards for agricultural products as the number of farming operations increases.

- FAO secures funding for these projects from various sources, including the Green Climate Fund (GCF) and the Global Environment Facility (GEF). The organization's efforts underscore the importance of maintaining food safety and security in the context of a growing global population.

What challenges does the Agricultural Microbials Industry face during its growth?

- Issues with product affordability is a key challenge affecting the industry's growth. Agricultural microbials, essential for enhancing crop productivity, face challenges in reaching developing countries, particularly in South America and Africa. Despite the benefits, high costs and limited accessibility hinder their implementation in these regions, where demand for crop production is significant. Products such as biopesticides, biofertilizers, and biostimulants all fall under the umbrella of agricultural microbials, offering effective solutions for crop protection and environmental sustainability.

- Price sensitivity among farmers in low- and middle-income economies is a major barrier, leading them to prefer traditional microbials over advanced organic alternatives. Lack of adequate information about advanced agricultural microbials further compounds the issue. These obstacles have far-reaching consequences, potentially impacting agricultural productivity on a large scale.

Exclusive Customer Landscape

The agricultural microbials market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the agricultural microbials market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, agricultural microbials market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AgBiome Inc. - The company offers agricultural microbials that stimulate natural plant processes, allowing the full expression of the plant's genetic potential, especially under stress conditions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AgBiome Inc.

- AGRICULTURE SOLUTIONS INC.

- Arysta LifeScience Corp.

- BASF SE

- Bayer AG

- Biomar Microbial Technologies

- Certis USA LLC

- Corteva Inc.

- Emnz

- Isagro Spa

- Koppert Biological Systems

- Lallemand Inc.

- LOCUS AG SOLUTIONS

- Novonesis Group

- Sumitomo Chemical Co. Ltd.

- Syngenta Crop Protection AG

- UPL Ltd.

- Verdesian Life Sciences LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Agricultural microbials have emerged as a significant segment in the global crop management market, offering sustainable solutions for farmers seeking to enhance crop productivity and resilience against biotic and abiotic stressors. These microbial products, derived from beneficial bacteria and other microorganisms, play a crucial role in organic agriculture by promoting soil health, enhancing nutrient availability, and providing natural pest control. The market dynamics are driven by several factors. The increasing demand for organic food products and the growing awareness of environmental impact have fueled the adoption of organic farming practices. Organic agriculture relies on natural methods for pest prevention and soil enhancement, making microbial products an essential component of this approach.

The use of agricultural microbials offers several advantages over conventional crop protection methods. Microbial insecticides and fungicides provide effective pest control while minimizing the environmental impact compared to synthetic chemicals. Moreover, the use of microbial products can help reduce the reliance on chemical fertilizers and promote soil structures that improve water retention and nutrient cycling. The market caters to various crops, including legume crops, cereals and grains, oilseeds and pulses, horticulture crops, and sugarcane. The market comprises a diverse range of microbial products, including soluble liquids, commercial formulations, and seed treatments. These products can be formulated as dry or liquid suspensions, foliar sprays, or soil treatments.

The market for agricultural microbials is not limited to large-scale commercial operations. Medium and small-sized enterprises also play a significant role in the market, catering to the growing demand for sustainable agricultural practices. Some of the common microorganisms used in agricultural microbials include lactic acid bacteria, soil bacteria, and viable microorganisms. The market is subject to various market forces. Biotic stressors, such as insect populations and fungal diseases, can impact crop yields and market demand. Abiotic stressors, such as climate conditions and storage requirements, can also influence market dynamics. The use of agricultural microbials can contribute to agricultural sustainability by reducing greenhouse gas emissions and promoting soil health.

For instance, the use of biological nitrogen fixation through rhizobium legume symbioses can help reduce the reliance on synthetic fertilizers. The market for agricultural microbials is expected to grow as farmers seek sustainable and effective solutions for crop management. The increasing awareness of food safety and environmental safety concerns is also driving the demand for microbial products in organic agriculture. However, the market faces challenges, such as regulatory requirements, production costs, and competition from chemical crop protection products. The market offers sustainable solutions for crop management, promoting agricultural sustainability and reducing the environmental impact of conventional farming practices.

The market dynamics are driven by various factors, including market demand, biotic and abiotic stressors, and the adoption of sustainable agriculture practices. The market caters to various crops and farm sizes and offers a diverse range of microbial products to meet the growing demand for organic food and sustainable agriculture.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.3% |

|

Market growth 2025-2029 |

USD 7.98 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.0 |

|

Key countries |

US, Germany, China, UK, Canada, France, Italy, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Agricultural Microbials Market Research and Growth Report?

- CAGR of the Agricultural Microbials industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the agricultural microbials market growth and forecasting

We can help! Our analysts can customize this agricultural microbials market research report to meet your requirements.